Understanding the Government State Pension Age Changes

Introduction to Government State Pension Age

The government state pension age is a crucial element of the UK’s social security system, determining when individuals can begin receiving their state pension. As life expectancy increases and demographic changes occur, the government periodically reviews and adjusts the state pension age. Understanding these changes is vital for current and future retirees to effectively plan their financial futures.

Recent Changes and Proposals

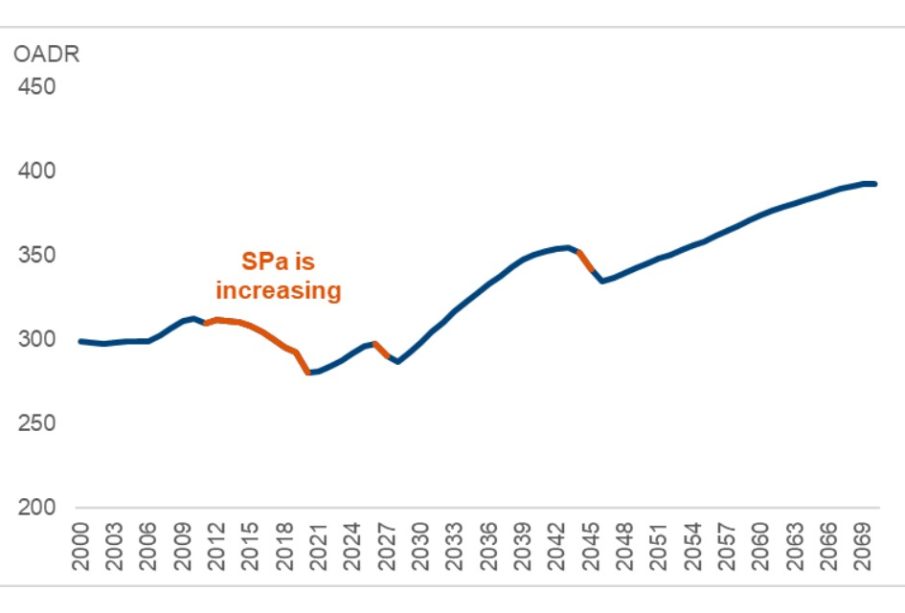

As of October 2023, the state pension age is set at 66 for both men and women, with plans to increase it to 67 by 2028. This planned increase has been met with mixed reactions among the population, particularly among those approaching retirement. Recent reports from the UK government suggest that further changes may come into effect sooner than previously anticipated, with proposals to raise the state pension age to 68 by 2037. Such changes have been proposed due to increasing life expectancy and economic pressures on the pension system.

The Importance of Preparing for Changes

With these changes on the horizon, it is crucial for individuals to consider how these adjustments impact their retirement planning. Those who are currently aged between 50 and 60 should pay particular attention, as any further increases could significantly affect their expected retirement timelines. Financial advisors recommend that individuals in this age bracket begin to reassess their plans and consider alternatives to ensure they are financially secure when they do retire.

Implications for Different Age Groups

For younger generations, such as millennials and Generation Z, the state’s pension age changes may seem distant, but they carry significant implications. With the increasing age of eligibility, many may need to work longer than previous generations to secure enough funds for retirement. The government has been encouraging saving into private pension schemes as supplementing the state pension becomes increasingly important. Additionally, the burden of funding pensions may affect younger workers, leading to potential challenges in employment and financial stability.

Conclusion: The Future of State Pension Age

The future of the government state pension age remains a topic of ongoing debate and concern, especially in light of an ageing population and economic pressures. Forecasts suggest that unless substantial reforms are implemented, changes to the pension age could become a regular occurrence. For readers, staying informed on this topic is essential, enabling individuals to adapt their retirement plans accordingly and secure their financial future amidst changing governmental policies.