Understanding the FTSE 100 Index: Trends and Insights

Introduction

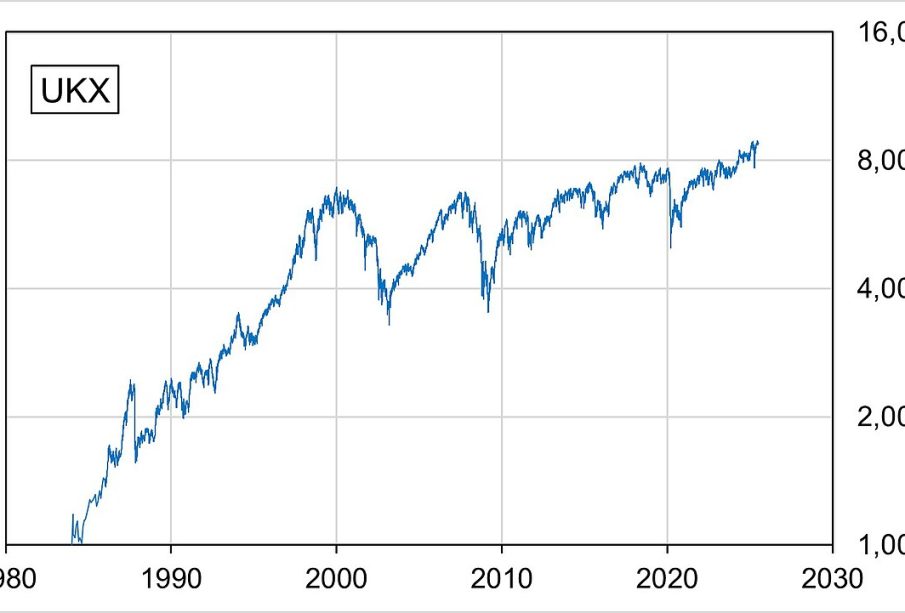

The FTSE 100 Index, often referred to simply as the ‘Footsie’, is a crucial benchmark for the performance of the largest companies listed on the London Stock Exchange. It represents a significant aspect of the UK economy and is closely monitored by investors for insights into the country’s financial health. Understanding the dynamics of the FTSE 100 is vital for both seasoned investors and those new to the stock market.

Current Trends in the FTSE 100

As of October 2023, the FTSE 100 Index has seen a fluctuation in its performance due to various global and local economic factors. Recent data indicates that the index is experiencing a partial recovery following a downturn earlier in the year, primarily influenced by stabilising inflation rates and shifts in consumer confidence. Major companies such as Unilever, BP, and AstraZeneca are key contributors to this index’s movements, reflecting the overall health of sectors like consumer goods, energy, and pharmaceuticals.

One noteworthy trend is the increasing focus on sustainable and ethical investment, which has led to a rise in share prices for companies scoring high on Environmental, Social, and Governance (ESG) criteria. This shift is indicative of a larger, global transition towards sustainable practices, compelling traditional firms to adapt or risk declining market relevance.

Economic Context and Factors Influencing the Index

The economic environment of the UK, including interest rates and domestic consumer spending, has a direct impact on the FTSE 100. With the Bank of England’s latest monetary policies focusing on managing inflation while ensuring economic growth, investor sentiments are cautiously optimistic. However, challenges like ongoing geopolitical tensions and supply chain disruptions continue to pose risks to stable growth.

Moreover, market analysts suggest that while the FTSE 100 has shown resilience, upcoming economic data releases, particularly concerning employment rates and earnings reports from major corporations, will be critical in determining its future trajectory.

Conclusion

The FTSE 100 Index remains a vital indicator of the UK’s economic performance and investor confidence. As we advance into the remainder of 2023, the interplay between inflation control measures and global economic trends will likely dictate the index’s movements. Investors should stay informed on these developments to navigate potential market shifts effectively. With the increasing focus on sustainability, the landscape may further evolve, creating new opportunities within the index that could shape the future of investing in the UK.