Understanding the FTSE 100 Index: Latest Trends and Insights

Introduction to the FTSE 100

The FTSE 100 Index, often referred to as the “Footsie,” represents the 100 largest companies listed on the London Stock Exchange. Its significance cannot be overstated, as it acts as a barometer for the overall performance of the UK economy and the broader market. Investors look to the FTSE 100 for insights into economic trends, making its movements critical for financial decision-making.

Current Performance and Trends

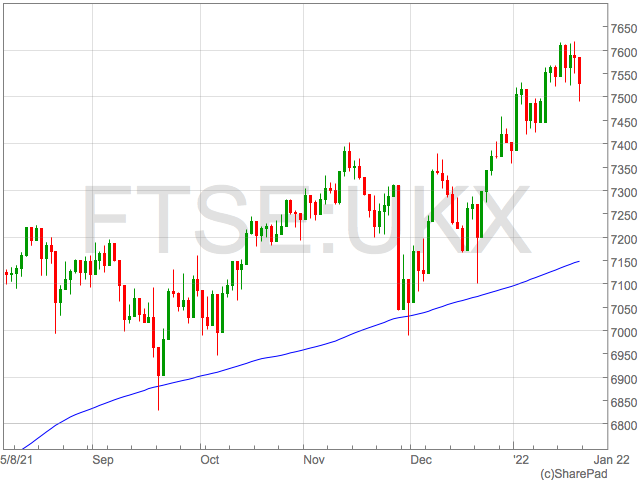

As of October 2023, the FTSE 100 has shown resilience amidst global economic uncertainties. With a recent uptick, the index reached levels not seen since the early stages of the pandemic recovery. Factors such as rising commodity prices and robust earnings reports from key sectors like technology and healthcare have driven this upward trend.

The index gained approximately 7% over the past quarter, a significant recovery attributed to the end of some geopolitical tensions and a stabilising UK economy. Companies like Shell and BP have recently reported substantial profits, buoyed by high energy prices, further lifting the index.

Challenges Facing the FTSE 100

However, obstacles remain. The ongoing inflation concerns and potential interest rate hikes from the Bank of England could pose risks to the index’s momentum. Investors are closely monitoring central bank communications for signals regarding monetary policy shifts. The potential fallout from these changes could result in increased volatility in the stock market.

Looking Ahead

Analysts predict that the FTSE 100 may continue to fluctuate based on global economic conditions and events such as upcoming elections and international trade agreements. As companies report their Q3 earnings, stakeholders will be keen to see how domestic and global challenges affect their outlooks.

Conclusion

In conclusion, while the FTSE 100 has navigated recent challenges successfully, its future remains contingent on broader economic indicators and organisational performances. Investors should remain vigilant and informed, as the index’s trends will play a significant role in investment strategies. Understanding these dynamics is crucial for anyone looking to engage with or invest in the market.