Understanding the Fluctuations of Apple Share Price

Introduction

The share price of Apple Inc. is a crucial indicator of its market performance and investor confidence. As one of the most valuable companies in the world, fluctuations in its share price are closely monitored by investors and analysts alike. Understanding these trends is significant not only for current shareholders but also for potential investors looking to gauge the company’s future potential in the technology sector.

Recent Trends in Apple Share Price

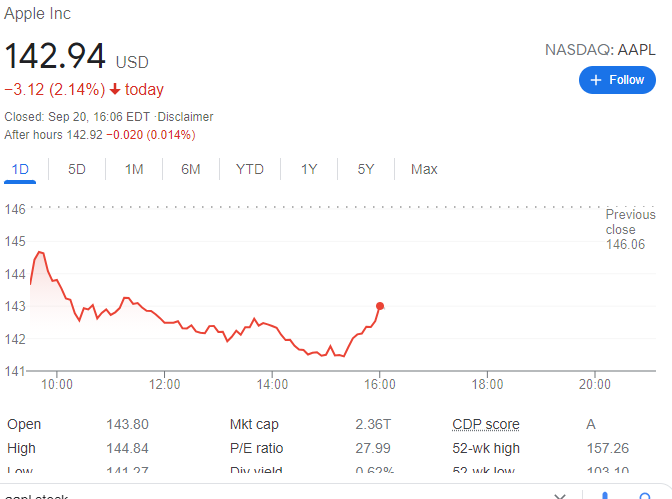

As of late October 2023, Apple’s share price has experienced notable volatility. Initially trading in the region of £145 per share, it recently fluctuated to approximately £130 amidst broader market corrections influenced by macroeconomic factors such as inflation, interest rates, and supply chain disruptions. This represents a considerable change from its peak share price of £175 earlier in the year.

Analysts attribute the recent downturn to several factors, including concerns surrounding global economic instability and rising competition in the smartphone market. Particularly, competitors like Samsung and emerging brands in Asia have gained traction, affecting Apple’s market share. Additionally, quarterly earnings revealed a slowdown in iPhone sales, contributing to investor hesitation.

Factors Influencing Apple’s Share Price

The performance of Apple’s stock is impacted by a myriad of elements. Quarterly earnings reports are significant as they provide insights into revenue streams and profitability. The most recent earnings release highlighted a slight decrease in revenue compared to prior quarters, primarily due to reduced demand for older iPhone models.

Furthermore, macroeconomic conditions, including changes in interest rates and inflation, directly affect investment decisions and can lead to higher volatility in stock prices. Technological advancements, product launches, and updates in services like Apple Music and Apple TV+ also play critical roles in shaping investor sentiment.

Conclusion and Future Outlook

Looking ahead, the future of Apple’s share price will likely depend on its ability to innovate and maintain customer loyalty. Forecasts remain cautiously optimistic, with many analysts suggesting that Apple could rebound if it successfully launches new products and expands its services division, which has shown robust growth.

In summary, the fluctuations in Apple’s share price are reflective of both internal company performance and external market conditions. For investors, staying informed on these trends and analysing the broader economic environment will be essential for making sound investment decisions in the ever-evolving tech landscape.