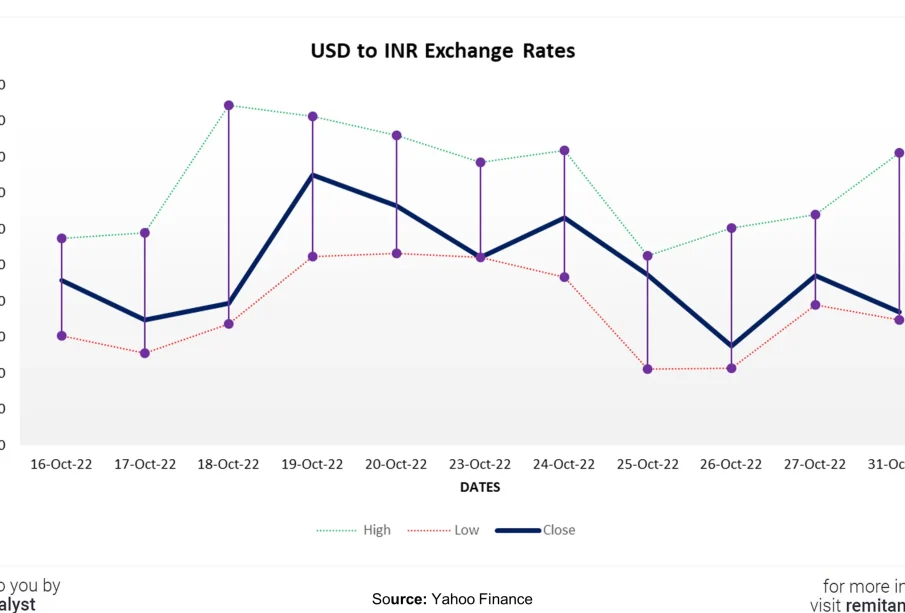

Understanding the Current USD to INR Exchange Rate

The Importance of USD to INR Exchange Rate

The exchange rate between the US Dollar (USD) and the Indian Rupee (INR) plays a vital role in international trade and finance. As of October 2023, fluctuations in this rate influence various economic factors such as imports, exports, and foreign investments. Understanding the trends in the USD to INR exchange rate is crucial for businesses, investors, and individuals involved in cross-border transactions.

Recent Developments

In recent weeks, the USD to INR exchange rate has experienced notable volatility. Following the Federal Reserve’s decision to maintain interest rates, the dollar strengthened globally, leading to a rise in the USD to INR rate, which peaked at around 83.50 INR per USD. This strengthening is partly attributed to persistent inflation in the US, prompting investors to seek protection in the dollar as a safe haven.

Factors Influencing the Exchange Rate

Several factors influence the exchange rate between the USD and INR. Key among these include:

- US Economic Indicators: Economic reports such as employment data, consumer spending, and GDP growth rates directly impact the strength of the dollar.

- India’s Economic Performance: The Indian economy’s growth trajectory, inflation rates, and policy decisions by the Reserve Bank of India significantly affect the rupee’s strength.

- Global Market Trends: Geopolitical events, commodity prices, and market sentiment can lead to fluctuations in the exchange rate.

Impact on Trade and Investments

The recent increase in the USD to INR rate may adversely affect Indian importers, particularly those reliant on commodities priced in dollars, such as oil. Conversely, exporters may find this beneficial, as higher dollar revenues translate to better returns in rupee terms. Additionally, foreign direct investment (FDI) flows into India may become more attractive to investors due to potentially higher returns in a depreciating rupee scenario.

Future Projections

As we look ahead, analysts forecast that the USD to INR exchange rate will remain subject to economic data releases from both the US and India. Market participants will closely monitor the Federal Reserve’s future actions on interest rates and the RBI’s monetary policy stance. Predictions suggest that the rate may stabilize in the coming months, but significant volatility remains a possibility due to the uncertain global economic landscape.

Conclusion

Understanding the dynamics of the USD to INR exchange rate is essential for anyone engaged in international commerce or investment activities. By staying informed about economic indicators and market conditions, stakeholders can make more strategic decisions that align with current trends and forecasts.