Understanding the Current Trends in the Dow Jones Index

The Importance of the Dow Jones Index

The Dow Jones Industrial Average (DJIA), commonly referred to as the Dow Jones, is one of the most significant stock market indices in the world. Composed of 30 major publicly traded companies in the United States, the DJIA serves as a barometer for the overall health of the US economy. Investors and analysts closely monitor the Dow due to its historical significance and its reflection of market trends.

Current Trends in the Dow Jones

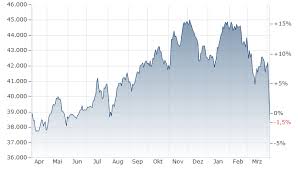

As of August 2023, the Dow Jones has shown a remarkable resilience in the face of economic fluctuations and uncertainties. Recent data indicates that the index has surpassed the 35,000 mark, a notable benchmark demonstrating recovery and investor confidence. Factors contributing to this surge include robust corporate earnings reports, easing inflation fears, and a relatively stable geopolitical climate.

The technology sector particularly played a pivotal role in this growth. Companies like Apple, Microsoft, and Visa have reported better-than-expected quarterly earnings, boosting the index’s overall performance. In addition, the anticipated end of aggressive interest rate hikes by the Federal Reserve has also provided a more favourable environment for investors.

Key Events Influencing the Dow

In recent weeks, several significant events have impacted the Dow Jones. The government’s announcement of a budget deal aimed at reducing the deficit has instilled further confidence in the market. Moreover, the upcoming presidential election has generated both optimism and anxiety, as policymakers begin to outline their economic strategies.

Furthermore, international developments, particularly in Asia, where economic growth appears to be stabilising, are expected to influence trends in the Dow Jones. As China navigates a pathway to recover from its strict pandemic measures, global supply chains are beginning to normalise, which could bolster American exports and service sectors, ultimately benefiting Dow companies.

Conclusion: What Lies Ahead for the Dow Jones

Looking ahead, analysts suggest that while the Dow Jones may experience short-term volatility due to investor sentiment or global events, the long-term outlook remains positive, contingent on steady economic growth and corporate profitability. As a critical indicator of market health, the Dow Jones will continue to be a focal point for both market participants and researchers. Understanding its trends provides valuable insights for investors seeking to navigate the complex financial landscape.