Understanding the Current Trends in Tesco Share Price

Introduction

The share price of Tesco PLC, one of the UK’s largest retailers, is a crucial indicator of the company’s health and market performance. Investors closely monitor Tesco’s share price as it reflects the retail sector’s dynamics, while also indicating consumer confidence and economic trends. In the context of a fluctuating economy and increasing competition in the grocery sector, understanding Tesco’s share price movements is essential for both investors and consumers.

Current Share Price Trends

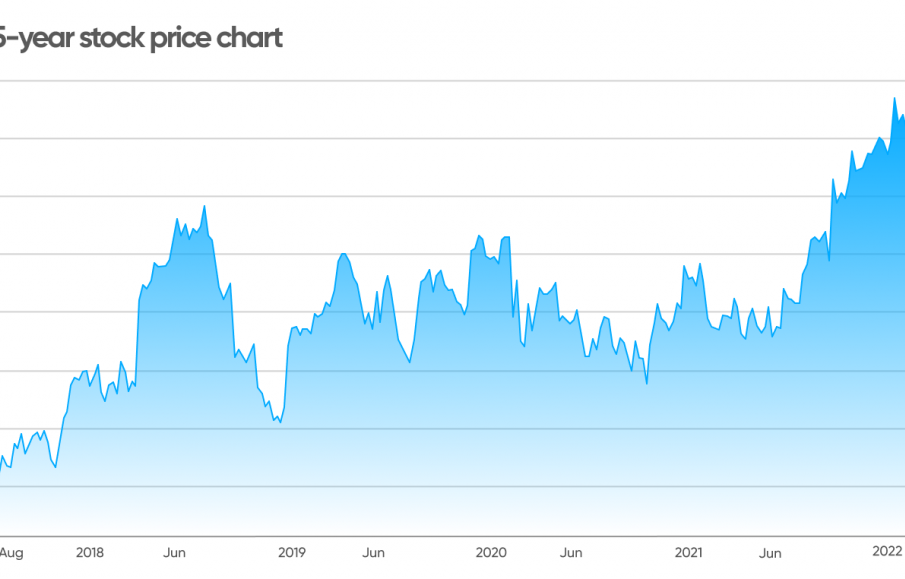

As of October 2023, Tesco’s share price has shown significant volatility, closing at around £2.55 per share recently. This is an essential downturn from earlier highs that saw the price nearing £3.00 in mid-2023. Analysts attribute this decline to several factors, including the impact of inflation, rising operational costs, and fierce competition from other grocery giants such as Sainsbury’s and Aldi. The two most significant forces influencing these trends are cost control measures and consumer spending patterns, heavily affected by the current economic climate.

Market Reactions and Analyst Predictions

Market reactions to Tesco’s operational updates have been mixed. In its latest quarterly reports, Tesco noted robust sales growth but warned of a potential slowdown in consumer spending, which could further affect its share price in the upcoming months. Analysts remain cautiously optimistic, with predictions suggesting that if Tesco can navigate these challenges effectively, its share price could stabilise within the £2.60 to £2.80 range by early 2024, depending on overall economic recovery and customer loyalty initiatives.

Investment Implications

For investors, the fluctuations in Tesco’s share price present both risks and opportunities. Some financial experts advise a buy strategy for long-term investors who believe in Tesco’s ability to adapt and thrive in a changing market. The supermarket chain is also heavily investing in technology to enhance online shopping and streamline operations, a move that could bolster future profitability and, as a result, its share price.

Conclusion

In conclusion, while the current trends in Tesco’s share price may raise concerns among investors, it also highlights the potential for recovery and growth as the market stabilises. With strategic investments and adaptations to changing consumer behaviours, Tesco has the opportunity to rebound and possibly outperform expectations in the coming months. For market participants, staying updated on Tesco’s financial performance and sector developments will be crucial for making informed investment decisions.