Understanding the Current Trends in Oil Price

The Importance of Oil Prices

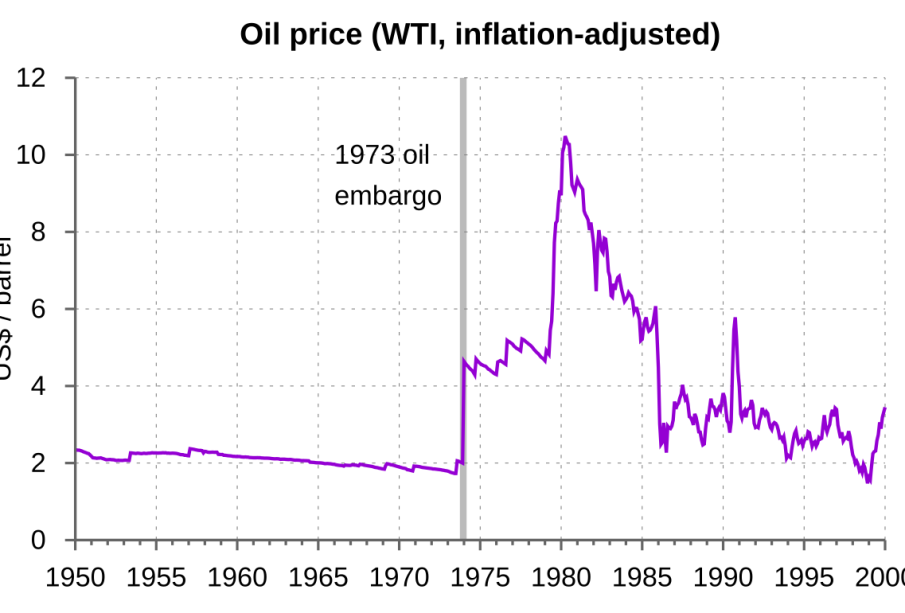

Oil prices are a vital economic indicator that hold significant relevance for both consumers and industries worldwide. Fluctuations in oil prices can impact everything from transportation costs to food prices, making it essential to stay informed about the current trends and their implications on the global economy.

Recent Developments in Oil Prices

As of October 2023, the oil market has witnessed considerable volatility driven by a mix of geopolitical tensions, OPEC+ production decisions, and fluctuating demand post-COVID-19. Recently, Brent crude and West Texas Intermediate (WTI) have both experienced substantial increases, reaching levels not seen since mid-2022. Analysts attribute this surge to factors such as escalating tensions in the Middle East, particularly as conflicts in regions like Ukraine and the Gaza Strip continue to impact supply chains.

Furthermore, OPEC+ has announced production cuts aimed at stabilising the market. These cuts, combined with strong demand from recovering economies, have put upward pressure on oil prices. For instance, the global demand for oil has been projected to increase by 2 million barrels per day as countries ramp up their economic activities.

The Global Impact of Rising Oil Prices

Rising oil prices can have profound implications for global economies. Increased fuel costs can translate to higher prices for consumer goods, straining household budgets. Additionally, countries that are heavily reliant on oil exports may benefit from higher prices, while those that depend on imports, like many European nations, may face economic challenges.

Moreover, the increase in oil prices often reignites discussions about the transition to renewable energy sources. High dependency on fossil fuels is being challenged by environmental policies aimed at reducing carbon footprints and combating climate change. Renewed investment in green technologies may emerge as a strategic response to fluctuating oil prices.

Conclusion: Looking Ahead

Forecasts for oil prices remain uncertain as they are influenced by a myriad of factors including geopolitical events, supply chain dynamics, and global economic recovery rates. While some analysts predict that prices may stabilise in the near future, others warn of potential spikes should further tensions arise globally.

For consumers and businesses alike, understanding these trends is crucial in making informed decisions. As oil prices continue to impact economic activities, staying updated with market forecasts will be key to navigating financial strategies effectively.