Understanding the Current Trends in Mortgage Rates

The Importance of Mortgage Rates

As the housing market becomes increasingly dynamic, understanding mortgage rates has never been more crucial for potential homebuyers and homeowners looking to remortgage. Mortgage rates, which are influenced by economic factors, central bank policies, and market sentiment, play a significant role in determining the affordability of home loans, impacting the real estate market at large.

Current Mortgage Rates in the UK

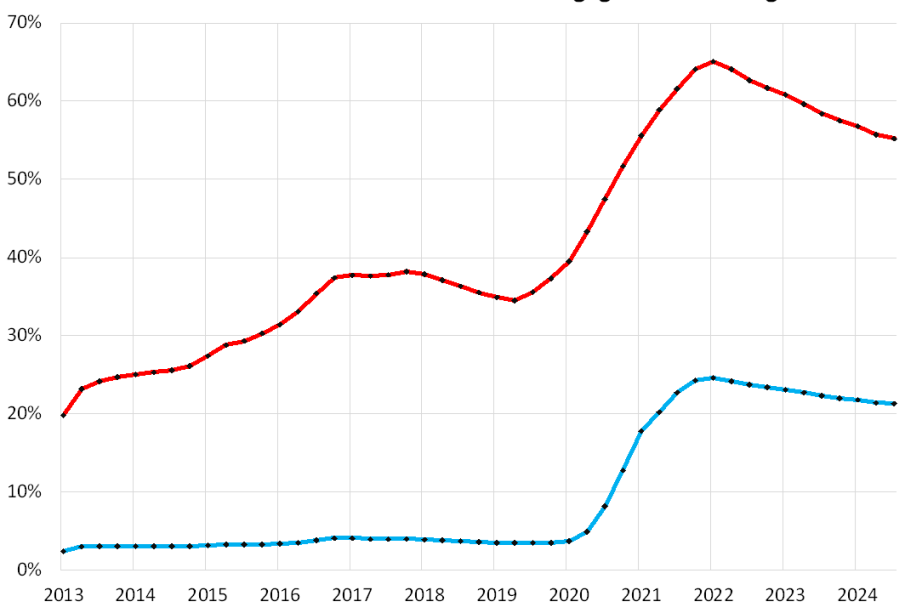

As of October 2023, mortgage rates in the UK have shown a noticeable upward trend. According to data from the Bank of England, the average interest rate for a two-year fixed-rate mortgage has risen to approximately 6.50%, while five-year fixed-rate mortgages are hovering around 6.20%. These increases are a response to the Bank of England’s ongoing efforts to combat inflation, which has remained stubbornly high.

In recent months, the Bank has raised the base interest rate to 5.25%, marking a significant shift from the historically low rates seen during the pandemic. This has led to a tighter lending environment, with mortgage lenders adjusting their products to mitigate risk. Reports indicate that many lenders are offering fewer deals, and borrowers are facing stricter lending criteria as a result.

Impact on Homebuyers and the Real Estate Market

The rise in mortgage rates has profound implications for homebuyers. Increased borrowing costs are making homeownership less attainable for many, especially first-time buyers. Higher monthly repayments mean that buyers may need to lower their budget or compromise on location and property size. This scenario has resulted in increased demand for rental properties, driving up rental prices across the country.

Furthermore, existing homeowners considering remortgaging are now confronted with choices that could substantially impact their financial situations. Analysts predict that many will opt for longer fixed-rate deals to secure themselves against potential future rate hikes, indicating a shift in consumer behaviour in response to the changing economic landscape.

Looking Ahead: What to Expect

As we approach the end of the year, experts anticipate that mortgage rates may stabilise or continue to rise, depending on the Bank of England’s decisions in relation to inflation. It is crucial for prospective homebuyers and homeowners alike to stay informed about market trends and to seek financial advice when necessary.

In conclusion, the fluctuation of mortgage rates reflects broader economic conditions and impacts a wide array of stakeholders in the housing market. Understanding these rates is essential for making informed decisions in the ever-evolving landscape of home financing.