Understanding the Current Trends in Meta Share Price

Introduction

The share price of Meta Platforms, Inc. (formerly known as Facebook, Inc.) is a hot topic in financial news this year. As one of the leading technology companies globally, Meta’s stock performance directly influences market trends, investor sentiments, and the broader tech sector. Understanding the current state of Meta’s share price is essential for investors, analysts, and anyone interested in the dynamics of the financial markets.

Recent Performance and Factors Influencing Meta’s Share Price

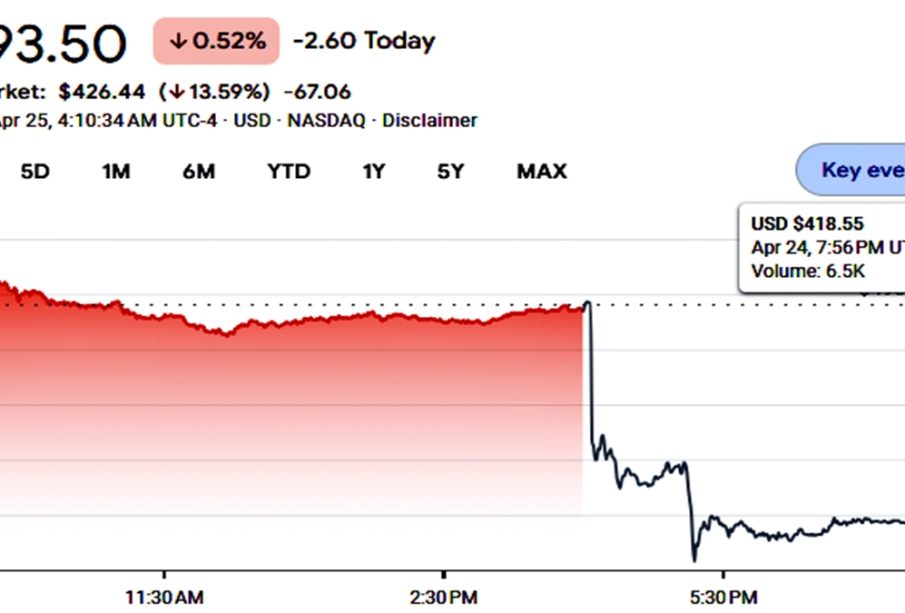

As of October 2023, Meta’s share price has seen fluctuations following various strategic decisions made by the company. After a period of significant decline and volatility in early 2022, where the stock dropped approximately 25% due to evolving competition and advertising challenges, the company’s recent initiatives have shown signs of recovery. Reports indicate that the stock has gained about 15% since the start of the year, recovering from its lows.

Several factors have contributed to this rise in share price. Meta’s pivot towards focusing on the metaverse and technological innovations, including improvements in AI and virtual reality, have sparked renewed interest among shareholders. Moreover, robust earnings reports released in the last couple of quarters showcasing increased revenue from advertising and successful monetisation efforts in Facebook and Instagram have positively affected investor confidence.

Additionally, industry analysis suggests that Meta’s strategic investments into new technologies are considered long-term growth opportunities, which are crucial in attracting new investors despite existing challenges such as regulatory scrutiny and competitive pressures from other tech giants like Google and Amazon.

Market Reactions and Future Projections

The financial markets have reacted cautiously optimistic to Meta’s share price movements. Analysts are divided on predictions; some believe that the company has potential for further recovery and growth, especially with the implementation of user-friendly features and enhancing privacy measures. On the flip side, challenging market conditions, potential economic slowdowns, and global concerns may hinder short-term growth.

Nevertheless, many analysts project a positive trajectory over the next few years, contingent upon Meta’s ability to successfully integrate its metaverse ambitions and sustain engagement across its platforms. Investors are advised to keep a close watch on upcoming earnings reports, endorsements from market experts, and changes in user metrics as indicators of forthcoming share price movements.

Conclusion

For investors, the current trends of Meta’s share price highlight both opportunities and risks inherent in investing in tech. While the recent performance suggests recovery, external pressures and internal changes will dictate the ongoing fluctuation of the share price. Understanding these factors will empower investors to make informed choices as they navigate the complexities of the market surrounding one of the world’s most influential tech companies.