Understanding the Current Lloyds Share Price Trends

The Importance of Tracking Lloyds Share Price

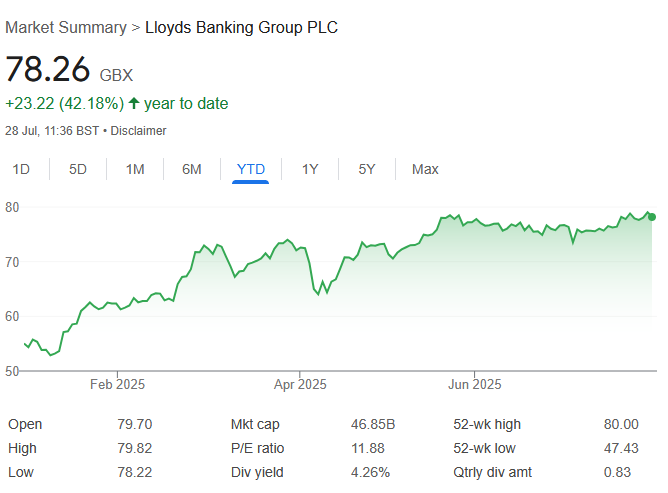

The Lloyds share price is a crucial indicator of the bank’s performance and market sentiment. As one of the largest financial institutions in the UK, Lloyds Banking Group plays a vital role in the economy. With ongoing fluctuations in the financial markets, understanding the share price can help investors make informed decisions about buying or selling shares.

Current Share Price and Market Trends

As of mid-October 2023, the Lloyds share price has seen a mixed performance. Currently trading at around £0.45, the stock has experienced a decline of approximately 10% over the past three months, largely attributed to economic concerns including inflation rates and uncertainties surrounding the UK housing market. Analysts predict that these factors will continue to impact Lloyds share price in the coming months.

In recent weeks, Lloyds’ stock has also been affected by broader market trends, including fluctuations in interest rates and changes in government monetary policy. The Bank of England’s decisions regarding interest rates will particularly impact the lender’s profitability, and therefore its share price.

Industry Performance and Predictions

Comparatively, Lloyds is performing in line with other UK banks, but investors are cautious. The banking sector is typically sensitive to economic changes, and with rising costs of living, loan defaults may rise, impacting banks’ earnings. Analysts remain divided on Lloyds’ prospects with predictions varying widely, but many see potential for recovery should economic conditions stabilise.

Conclusion: Key Takeaways for Investors

In conclusion, the current Lloyds share price reflects broader economic challenges and the unique considerations affecting the financial sector. For potential investors, it’s crucial to stay updated on both market trends and the socio-economic environment. Sentiment towards the banks may shift in response to economic data, making it essential to approach investment decisions with a wide-ranging perspective.

Forecasting the Lloyds share price involves considering numerous external factors, including fiscal policy changes and consumer behaviour. The upcoming quarterly earnings report will provide further insights into the bank’s performance and may influence investor sentiment moving forward. For those monitoring Lloyds shares, now is a critical time to assess not only market conditions but also personal investment strategy.