Understanding the Current Landscape of NVDA Stock

Introduction

NVIDIA Corporation, commonly recognized by its stock symbol NVDA, has been a significant player in the technology sector, particularly in graphics processing and artificial intelligence. As of October 2023, NVDA stock is gaining increasing attention among investors and analysts alike, given its pivotal role in the semiconductor market and the ongoing advancement of AI technologies. This article explores the recent trends in NVDA’s stock performance, factors influencing its valuation, and its future outlook.

Recent Performance Trends

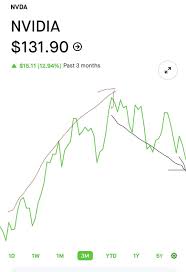

In the last quarter, NVDA stock has demonstrated remarkable resilience, trading at approximately £450 per share, showing year-to-date growth of over 150%. Notably, in August 2023, the company reported its Q2 earnings, exceeding market expectations with revenue reaching £13.5 billion, driven by robust demand in its data centre segment, which rose by 50% compared to the previous year. The surge in the AI market, where GPUs are crucial for training and deploying machine learning models, has been a significant catalyst for this growth.

Key Growth Drivers

Several factors contribute to the bullish sentiment surrounding NVDA stock. The company is strategically positioned to benefit from the AI revolution, with its GPUs being widely adopted across various sectors such as autonomous vehicles, healthcare, and cloud computing. Furthermore, NVIDIA’s recent partnerships with major tech firms, including a multi-billion dollar deal with Microsoft and collaborations with Google Cloud, reinforce its dominant market position. Analysts also anticipate that ongoing investments in AI infrastructure will continue to drive long-term growth.

Challenges Ahead

Despite its impressive performance, NVDA stock is not without challenges. The technology sector is notoriously volatile, and factors such as supply chain disruptions or shifts in regulatory policies regarding semiconductor production could impact the company’s trajectory. Moreover, increased competition from other semiconductor manufacturers, including AMD and Intel, may also pose a threat to its market share.

Conclusion

As investors weigh the potential risks and rewards, NVDA stock remains a focal point in the equity markets. Analysts generally maintain a positive outlook, with many projecting further appreciation in the stock price in light of sustained demand for AI and graphics processing solutions. For readers, staying informed about NVIDIA’s quarterly results, industry developments, and overall economic conditions will be essential in assessing the stock’s future potential in an ever-evolving market landscape.