Understanding the Current Gold Price in India

Introduction

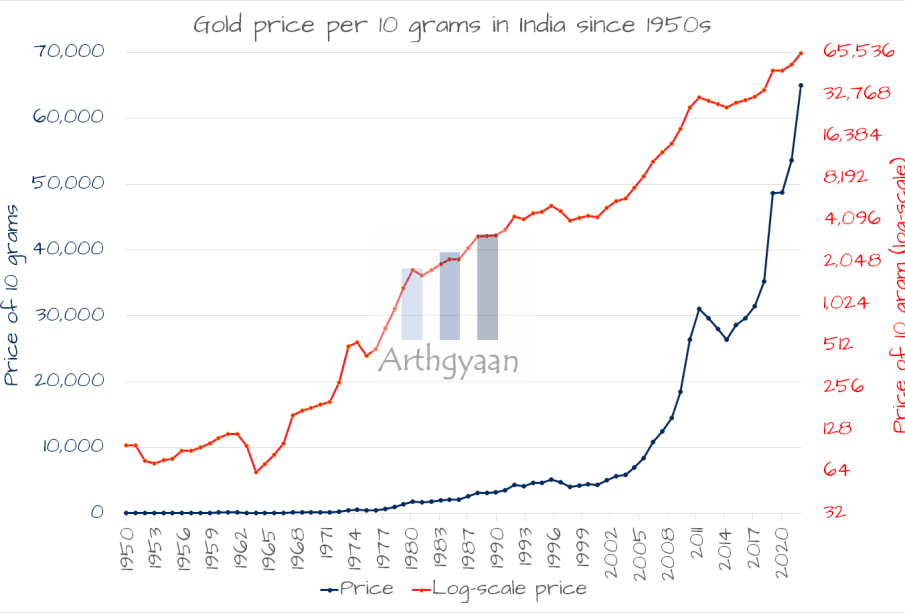

The gold price in India holds substantial significance, both as a cultural cornerstone and an economic indicator. Gold is not just a preferred choice for investment but also a treasured asset in Indian households. With the festival season approaching, understanding the current fluctuations in gold prices becomes crucial for buyers and investors.

Current Trends and Influencing Factors

As of October 2023, the gold price in India is witnessing a fluctuating trend. As per the latest data from the Multi Commodity Exchange (MCX), the gold price is hovering around ₹55,000 per 10 grams, marking a slight increase from the previous months. Several factors contribute to these price changes, including global market trends, currency fluctuations, and demand-supply dynamics.

Recent geopolitical tensions, particularly in major gold-producing nations, have contributed to driving gold prices higher as investors seek safe-haven assets. Additionally, ongoing inflationary pressures worldwide have increased the appeal of gold as a hedge against declining purchasing power.

Moreover, the Indian government’s policies regarding import duties and regulations on gold trading also play a pivotal role in the domestic market pricing. Analysts have noted that any changes in these regulations have often led to immediate fluctuations in gold prices across major cities.

Market Predictions

Experts predict that gold prices may continue to exhibit volatility in the coming months, given the uncertain economic climate. Analysts suggest that seasonal demand during festivals such as Diwali and weddings in 2023 could provide an upward push to prices. Furthermore, global trade relations and the Reserve Bank of India’s monetary policies would be essential to keeping an eye on for future trends.

Conclusion

For Indian consumers and investors, staying informed about the gold price in India is vital, especially in the context of cultural significance and financial strategy. As prices remain dynamic, potential buyers are advised to monitor market trends closely and consider both immediate and long-term perspectives while making purchasing decisions. With informed choices, buyers can navigate the complex landscape of gold investment more effectively, especially as the festival season approaches.