Understanding the Current Dynamics of Stock Markets

Introduction

The stock markets play a crucial role in the financial landscape, representing the economic health of a country and serving as a barometer for investor confidence. As of late 2023, understanding the current dynamics in stock markets is more important than ever due to ongoing geopolitical tensions, inflationary pressures, and shifts in monetary policy. Investors, analysts, and everyday citizens must pay attention as changes in these markets can significantly affect savings, pensions, and investment portfolios.

Current State of Global Stock Markets

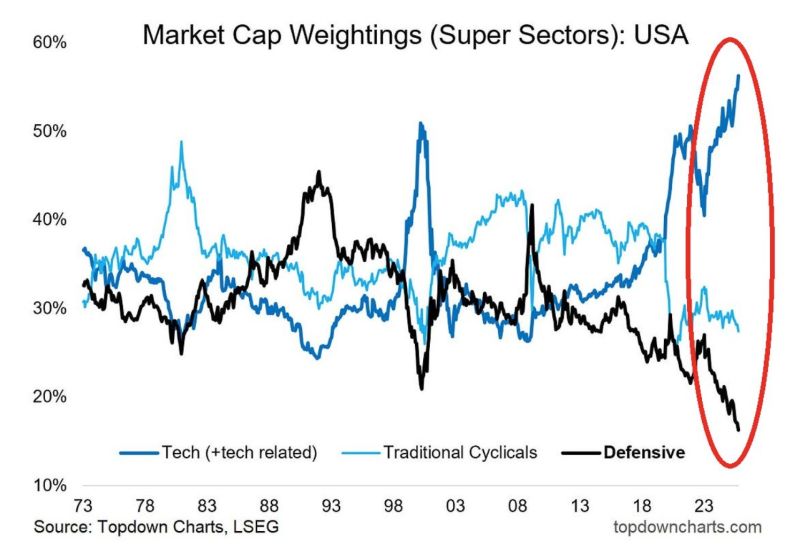

As of the third quarter of 2023, stock markets around the world have exhibited significant volatility. The FTSE 100 in the UK is currently navigating challenges due to inflation concerns and interest rate hikes. Despite these hurdles, UK stocks have shown resilience, with sectors like energy and finance rebounding from earlier slumps. Meanwhile, the New York Stock Exchange is marked by fluctuating technology stocks amid ongoing discussions about regulation and privacy issues.

Key Events Impacting Stock Markets

Several factors have contributed to the recent trends in stock markets:

- Interest Rate Changes: The Bank of England and the Federal Reserve in the US have adjusted interest rates to combat inflation, influencing market behaviours significantly.

- Geopolitical Tensions: Ongoing conflicts and tensions in Eastern Europe and Asia have resulted in market uncertainty, impacting investor sentiment.

- Corporate Earnings Reports: The third quarter earnings reports have been mixed, with some companies exceeding expectations while others have struggled due to rising costs.

Impact on Investors and Future Predictions

For individual investors, the current state of the stock markets necessitates a cautious approach. Financial advisors recommend diversifying portfolios to mitigate losses from potential market downturns. Looking ahead, analysts predict that stock markets could stabilise if inflation rates decrease and geopolitical situations improve. However, uncertainty remains a significant player in market predictions.

Conclusion

In summary, the current state of stock markets reflects a complex interplay of economic factors, international relations, and corporate performance. Investors should remain informed and prepared for ongoing volatility. Staying abreast of financial news, changes in monetary policy, and global events will be crucial for making sound investment decisions in the months to come. The significance of understanding these dynamics cannot be understated, as they affect not only individual investments but also broader economic trends.