Understanding the Bank of England Base Rate: Recent Developments

Introduction

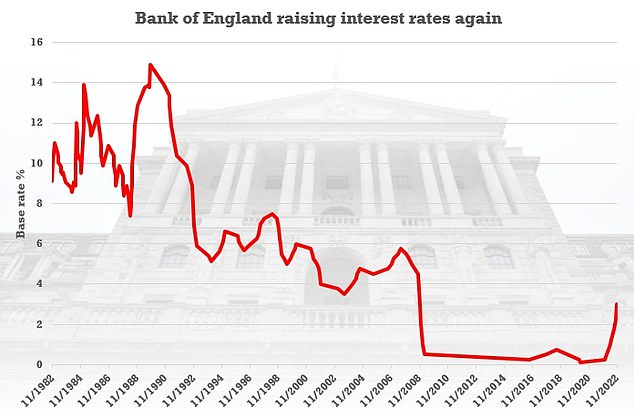

The Bank of England Base Rate is a crucial indicator of the cost of borrowing in the UK, influencing mortgages, loans, and savings. Recently, it has garnered significant attention as the Bank navigates the challenges posed by inflation and economic recovery post-pandemic. Understanding the current state and implications of the Base Rate is essential for consumers, businesses, and investors alike.

Current Status of the Base Rate

As of November 2023, the Bank of England has set the Base Rate at 5.5%. This decision follows a series of incremental increases aimed at combating rising inflation, which has reached levels not seen in decades. The last rate hike occurred in September 2023, when the rate was increased by 0.25 percentage points. The Bank’s Monetary Policy Committee has emphasised its commitment to bringing down inflation, which is crucial for maintaining purchasing power and economic stability.

Impact on Borrowing and Spending

The Base Rate directly affects interest rates for loans and mortgages. With the current rate at 5.5%, consumers are facing higher borrowing costs. For a typical variable-rate mortgage holder, this means increased monthly repayments, putting pressure on household finances. Additionally, as businesses also grapple with higher interest costs, investment decisions may be deferred, potentially slowing down economic growth.

Future Predictions

Economists are divided on the future trajectory of the Base Rate. Some predict further increases if inflation remains stubborn, while others suggest a pause in rate hikes as signs of economic strain become apparent. The Bank of England will likely continue to monitor inflation closely, adjusting policy as needed. The overall consensus is that the Base Rate will remain high for the foreseeable future, with potential stability expected in mid-2024 if inflation targets are met.

Conclusion

The Bank of England Base Rate is a pivotal element in the UK’s economic landscape, affecting financial decisions for millions. As the Central Bank responds to fluctuating inflation and economic performance, understanding the implications of the Base Rate becomes vital for consumers and investors. Keeping abreast of future changes will be crucial in navigating these uncertain economic times.