Understanding the Bank of England Base Rate and Its Impact

Introduction

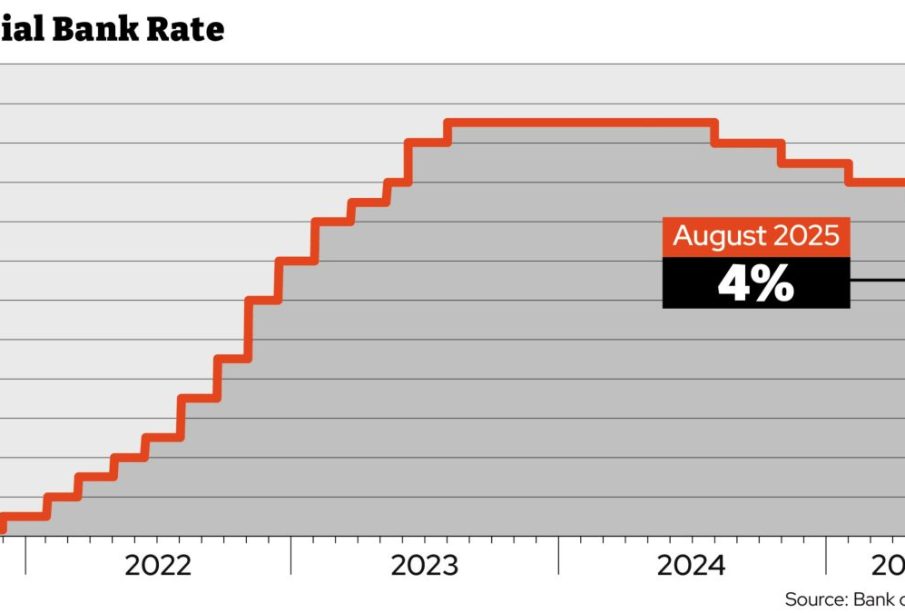

The Bank of England base rate is a crucial monetary tool in the UK’s economy, influencing borrowing costs, inflation, and economic growth. As the foundation for interest rates across various financial products, understanding its fluctuations is essential for both consumers and investors. Recent adjustments to the base rate have garnered significant attention amidst ongoing economic challenges.

Recent Changes to the Base Rate

As of October 2023, the Bank of England has maintained the base rate at 5.25%. This rate has been subject to change in response to inflationary pressures which peaked earlier in the year. After sharp increases in the preceding months, particularly a rise by 0.25% in August 2023, the decision to hold steady reflects a cautious approach amid fears of recession. The threat of rising inflation, edging above the government’s target of 2%, has forced the Bank to act decisively to ensure price stability.

The Economic Context

Inflation, driven by various factors including supply chain disruptions and energy prices, has led many analysts to speculate on future adjustments to the base rate. The International Monetary Fund has also noted that the UK’s growth outlook remains fragile, suggesting more stringent monetary policies could be introduced if inflation persistently remains high. This context plays a vital role in how the Bank of England formulates its strategies, considering the balance between curbing inflation and fostering economic growth.

Implications for Consumers and Businesses

The Bank of England base rate affects several aspects of everyday life. For consumers, a higher base rate usually means increased borrowing costs for mortgages and loans. Conversely, savers may benefit from better interest rates on savings accounts. Businesses, particularly those reliant on loans for operations and expansion, must also navigate these changes. Analysts predict that continued stability in the base rate could lead to a more predictable environment for planning and investment.

Conclusion

Monitoring the Bank of England base rate is crucial for anyone affected by interest rate changes, including homeowners, savers, and business owners. With the potential for further adjustments linked to economic performance, it is imperative for stakeholders to stay informed about monetary policy trends. The upcoming months may be critical as the Bank weighs its options in an uncertain economic landscape, suggesting that vigilance and adaptability will be key for those influenced by these changes.