Understanding the BAE Share Price and Its Market Impact

Introduction

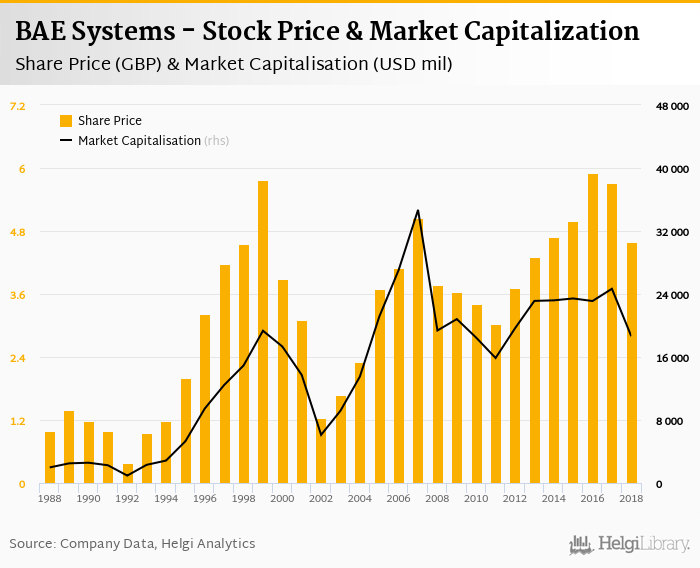

The BAE share price is a critical indicator of the financial health and market performance of BAE Systems, a leading global defence, security, and aerospace company. The company plays a vital role in supporting national security and technological advancement in various sectors. Understanding the fluctuation of BAE’s share price is essential for investors and stakeholders, especially in a contemporary market characterized by geopolitical tensions and shifts in defence spending.

Current Events Surrounding BAE

As of October 2023, BAE Systems has seen a considerable uptick in its share price, attributed to an increase in global defence budgets amid rising security threats. Following the recent geopolitical developments, including heightened tensions in Eastern Europe and Asia, governments are prioritising defence spending. This has resulted in several significant contracts awarded to BAE Systems, boosting investor confidence.

According to reports, BAE Systems recently secured a £4 billion contract to provide advanced missile systems to the Royal Navy. This contract is expected to significantly enhance the company’s revenue stream and strengthen its position in the defence sector. Analysts have reacted positively, leading to a forecast that the share price may continue on an upward trajectory in the coming months.

Performance Analysis

In the past month, BAE’s share price has increased by approximately 12%, closing at £9.75 on the LSE amid higher trading volumes and positive market sentiment. Analysts are optimistic about BAE’s ability to deliver robust financial results for the upcoming quarter, driven by steady demand for its innovative military solutions. Investors are advised to monitor quarterly earnings reports and global defence spending trends, which may provide further impetus for share price movements.

Conclusion

The BAE share price is not only a reflection of the company’s current performance but also an indicator of broader trends in defence spending and geopolitical stability. Given the current global landscape and increased investment in defence, BAE Systems is likely to maintain a strong position in the market. Investors should remain vigilant, considering both potential risks and growth opportunities that might arise as the company continues to navigate through the complexities of the global defence sector. Overall, the forecast for BAE’s share price appears positive, supported by new contracts and strategic partnerships that enhance its market competitiveness.