Understanding Recent BOE Interest Rate Changes

Introduction

The Bank of England (BOE) plays a crucial role in the UK economy, primarily through its control of interest rates. The BOE interest rate affects borrowing costs, saving rates, and economic growth. Recent discussions and movements regarding the interest rate have significant implications for individuals, businesses, and the overall economic landscape.

Current Trends in BOE Interest Rates

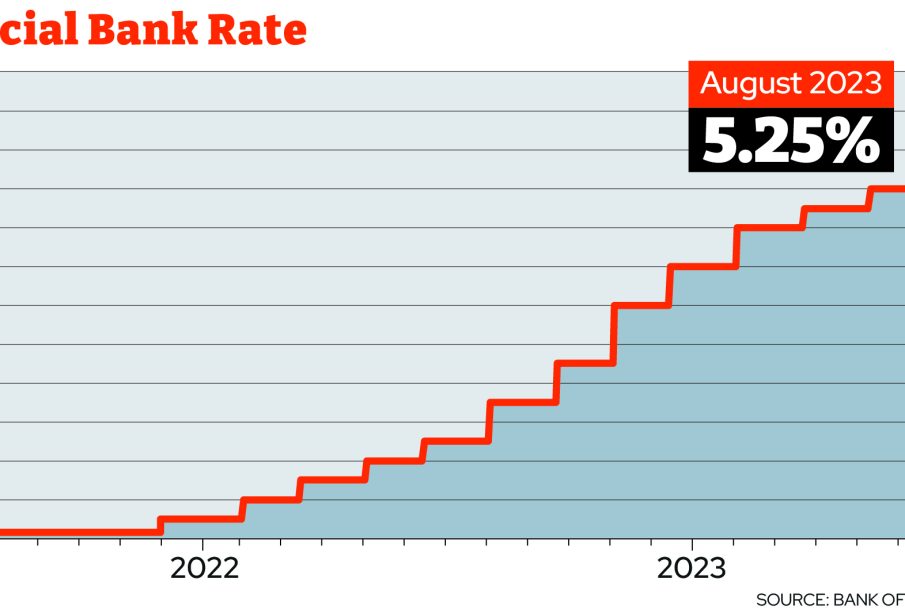

As of October 2023, the BOE has maintained a base interest rate of 5.25% following a series of hikes over the past year aimed at tackling inflation that peaked earlier this year. In its latest meeting, the Monetary Policy Committee (MPC) voted unanimously to keep rates stable after a thorough examination of economic indicators, including consumer spending and unemployment rates. Experts suggest that the BOE remains cautious, weighing the balance between stimulating growth and controlling inflation.

Economic Indicators Influencing the Rate

Key factors influencing the BOE’s decisions include rising energy prices, disruptions in supply chains, and fluctuating demand linked to post-pandemic recovery patterns. Inflation has remained above the BOE’s target of 2%, with latest figures indicating a rate of approximately 4.5%. Analysts predict that further interest rate adjustments may be needed should inflation persist. Additionally, the labour market shows signs of resilience, with unemployment hovering around 4%, prompting a mixed outlook on consumer spending and investment.

Reactions from Markets and Economists

The stability of the interest rate has yielded varied responses from market analysts. Some economists argue that maintaining the current rate will foster a more stable environment for economic recovery. In contrast, others believe that further hikes may be inevitable if inflation does not recede. The immediate response in the stock market was cautious optimism, although volatility is expected in reaction to future economic reports and central bank communications.

Conclusion

The future trajectory of the BOE interest rate is contingent upon incoming economic data and inflation trends. The balance between promoting growth while containing inflation poses a formidable challenge for the BOE. For the average consumer and investor, understanding these shifts in the interest rate is essential for making informed financial decisions. With forecasts suggesting possible adjustments in the coming months, stakeholders are advised to remain vigilant and prepared for the implications that BOE interest rate changes could have on their financial planning.