Understanding Premium Bonds: Features and Benefits

Introduction

Premium Bonds are a unique savings product offered by National Savings and Investments (NS&I) in the UK. Launched in 1956, they have become a popular method of saving for many individuals, combining the security of government backing with the excitement of a lottery-style prize draw. With current economic uncertainties and low-interest rates on traditional savings accounts, Premium Bonds have gained renewed attention as an attractive alternative.

How Do Premium Bonds Work?

When you purchase Premium Bonds, you are essentially buying chances to win cash prizes in monthly draws, rather than earning interest in the conventional sense. Each bond costs £1, with a minimum purchase of £25 and a maximum holding limit set at £50,000. Every £1 bond is entered into a monthly prize draw, where tax-free prizes ranging from £25 to £1 million are awarded. The odds of winning are determined by the number of bonds in circulation, currently set at around 24,000 to 1 for each £1 bond.

Recent Developments

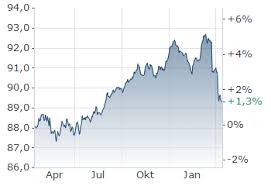

As of October 2023, the prize fund for Premium Bonds has witnessed a significant increase, now standing at £44 million for the October draw alone. This increase is largely attributed to the rising number of bondholders, which has surpassed 24 million, highlighting a growing interest in secure investments amidst financial instability. The current prize rate stands at 3.40%, meaning that over the past year, the return of winnings has become increasingly appealing to the savers who seek security and potential rewards.

Benefits of Premium Bonds

- Risk-Free Investment: Backed by the UK government, Premium Bonds are considered one of the safest investment options available.

- Tax-Free Prizes: Any rewards won are completely tax-free, allowing savers to keep the full amount.

- Liquidity: Investors can cash in their bonds at any time after the minimum holding period, making them a flexible option.

- Excitement of Winning: The chance of winning large cash prizes adds an element of excitement to saving.

Conclusion

In conclusion, Premium Bonds offer UK consumers a blend of security and excitement, making them an attractive saving product especially during challenging economic times. As the landscape of savings evolves and interest rates remain favourable, the popularity of Premium Bonds is expected to grow further. For individuals seeking a safe way to save money while also having the potential to win cash prizes, Premium Bonds present a compelling option.