Understanding Pension Credit: A Comprehensive Update for 2023

Introduction

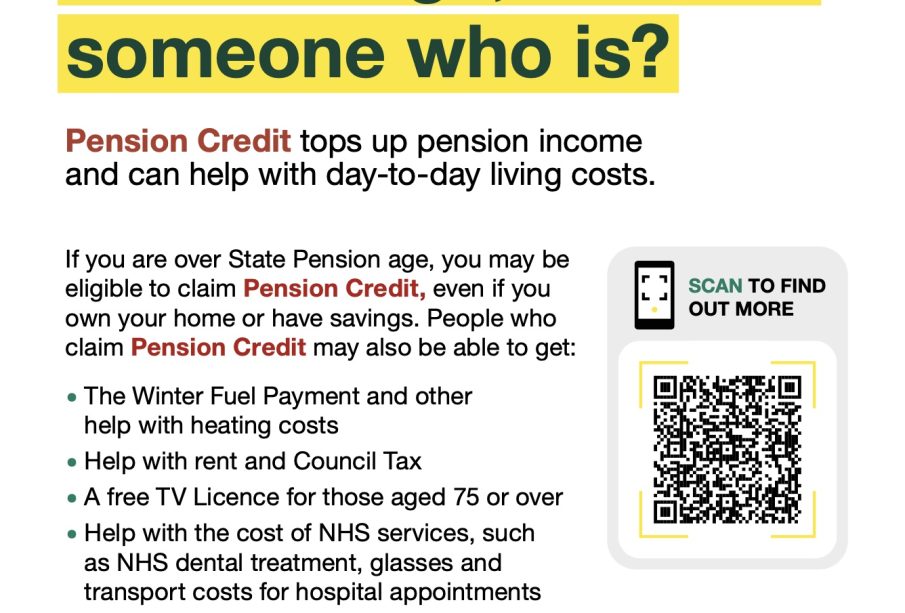

Pension Credit is a crucial financial support system for older adults in the United Kingdom, designed to assist those on low incomes. With rising living costs and an increasing number of individuals reaching retirement age, understanding Pension Credit has never been more important. Recent announcements and changes by the UK government have brought this topic to the forefront, affecting millions of pensioners seeking financial assistance.

Current Changes and Updates

As of October 2023, the UK government has made significant revisions to the Pension Credit system to ensure it meets the needs of a changing demographic. The basic rate for single pensioners has increased to £201.05 per week, while couples can receive up to £306.85 weekly. Additionally, the threshold for qualifying has been adjusted to reflect inflationary pressures, with more individuals eligible to receive benefits than in previous years.

Recent data indicates that around 2 million pensioners are currently missing out on Pension Credit, which can significantly uplift their financial status. The rise in the cost of living, particularly in energy and food prices, has prompted variations in claims. The government has also launched a campaign to encourage older individuals to check their eligibility and apply for this benefit.

Eligibility Criteria

To qualify for Pension Credit, applicants must be over the state pension age and have a low income, which can include savings and certain financial assets. Notably, individuals aged 75 and over might be eligible for additional support such as the ‘Pension Credit Guarantee’. Those with disabilities or caring responsibilities may receive further allowances. The eligibility criteria have been simplified to facilitate the application process, enabling more people to access the help they need.

Significance and Future Outlook

Pension Credit is vital for many older adults, providing a safety net that prevents poverty among the elderly. The upcoming winters, with anticipated energy crises, underscore the importance of this support. Financial advisors recommend that individuals nearing retirement should engage with Pension Credit resources to maximise their entitlements.

In conclusion, understanding and accessing Pension Credit is crucial for ensuring that seniors can enjoy a stable financial future. With ongoing outreach from the government and increased benefits, 2023 presents a pivotal opportunity for eligible individuals to enhance their financial wellbeing. For readers, remaining informed about these changes can significantly impact their quality of life or that of family members approaching retirement.