Understanding Palantir Stock: Performance and Future Outlook

Introduction

Palantir Technologies Inc. (NYSE: PLTR) has been a topic of significant interest among investors, analysts, and tech enthusiasts alike. Known for its advanced data analytics platforms, the company has experienced varying degrees of stock performance since going public in 2020. Understanding the intricacies of Palantir stock is vital for discernment about investment prospects, particularly in the context of the current economic landscape and technological advancements.

Current Performance

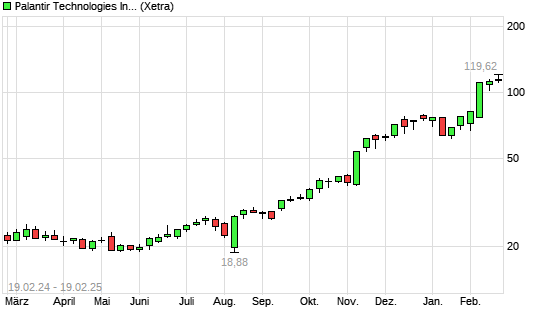

As of mid-October 2023, Palantir stock has shown resilience, with shares trading around $17.50, reflecting a year-to-date increase of approximately 14%. The company recently reported a strong quarterly earnings performance, exceeding analysts’ expectations with revenue exceeding $520 million, a 22% increase year-over-year. The growth is attributed to expanding commercial contracts and increased demand for data-driven decision-making tools, particularly in sectors like defence, healthcare, and finance.

However, the stock’s journey has not been without its challenges. Investors have expressed concerns about Palantir’s reliance on government contracts—approximately 56% of its revenue comes from this segment—as this could pose risks should government spending patterns shift. Additionally, competition in the data analytics space is intensifying, with companies like Snowflake and Databricks gaining traction with alternative solutions.

Corporate Developments

Palantir’s recent initiatives to broaden its product offerings are noteworthy. The launch of its Foundry platform for public sector clients illustrates its strategy to cater to both government and commercial sectors. Furthermore, the company has focused on expanding its partnerships globally, recently securing contracts in Europe and Asia, which has further diversified its revenue streams.

Future Outlook

Looking ahead, analysts are cautiously optimistic about Palantir’s growth potential. With increased scrutiny on data privacy and the rising significance of AI technologies, Palantir is well-positioned to benefit from these trends. According to a recent report by Barclays, the stock remains a strong buy, with a target price of approximately $23, indicating a considerable upside potential from current levels.

Conclusion

In conclusion, whilst Palantir stock presents exciting opportunities, potential investors should carefully weigh the associated risks, particularly concerning government dependency and competitive pressures. The company’s ongoing innovations and strategic expansions provide grounds for optimism, but as always, vigilance in investment decisions is essential. Investors would do well to keep a close eye on market conditions and the company’s performance to make informed choices regarding Palantir stock.