Understanding LVMH Share Price Trends

Introduction

The share price of LVMH Moët Hennessy Louis Vuitton, the world’s leading luxury goods conglomerate, has become a focal point for investors and analysts alike. As global demand for luxury products continues to grow, understanding the movements of LVMH’s share price is crucial for those interested in the stock market and luxury sector. The performance of LVMH is often seen as a barometer for luxury spending worldwide, making it an important topic of discussion.

Recent Performance

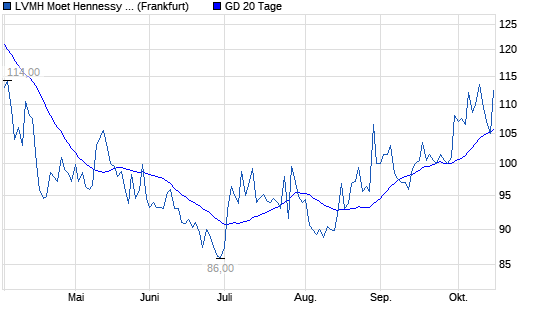

As of October 2023, LVMH’s share price has exhibited significant resilience despite challenges posed by economic fluctuations and changing consumer behaviour. The company reported a strong revenue growth of 15% in the third quarter of 2023, driven primarily by robust sales in the fashion and leather goods segment. Such growth has supported a positive outlook for the share price, which is currently trading around €710 per share, up from €650 earlier in the year.

Key Factors Influencing Share Price

Several factors are influencing LVMH’s share price:

- Global Economic Conditions: The overall health of the global economy, especially in key markets like China and the US, directly impacts LVMH’s performance. Recent economic recovery in these regions has been beneficial.

- Consumer Trends: As disposable incomes rise, so does the demand for luxury goods. Trends show that younger consumers are increasingly investing in luxury, positively affecting LVMH’s sales.

- Strategic Acquisitions: The company’s strategic expansion through acquisitions, such as the recent purchase of an Italian fashion brand, has also been a positive driver for its share performance.

Market Reactions

Investors have reacted positively to LVMH’s quarterly results, with shares rising approximately 8% in the past month alone. Market analysts are bullish on the stock, citing LVMH’s strong brand portfolio and excellent management as key strengths. Many analysts have revised their price targets upwards, projecting the share price could reach €800 by next year if current trends continue.

Conclusion

In summary, LVMH’s share price reflects not just the company’s performance but also broader trends in the luxury goods sector and global economic conditions. As the company continues to innovate and expand, it remains a critical player for investors focusing on luxury markets. Observers recommend keeping an eye on LVMH’s upcoming financial results, which will likely influence investor sentiment and share price in the near future.