Understanding Jerome Powell’s Influence on Economic Policy

Introduction

Jerome Powell, the current Chair of the Federal Reserve, holds a pivotal role in shaping the economic landscape of both the United States and global markets. His approaches to monetary policy and interest rates are closely monitored by economists, businesses, and governments alike. Powell’s decisions have significant implications on inflation, employment rates, and overall economic growth, making his leadership critical in the current post-pandemic economic recovery.

Recent Developments in Monetary Policy

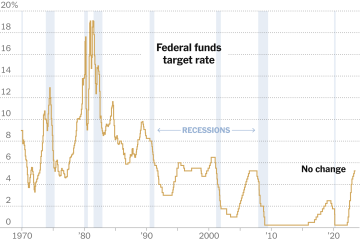

Recently, Powell and the Federal Reserve have faced mounting challenges as inflation rates reached their highest levels in decades, driven by supply chain disruptions and increased consumer demand following the pandemic. In response, Powell has signalled a shift towards tightening monetary policy. The Fed started increasing interest rates earlier this year, with an intention to combat inflation effectively. In a recent press conference, Powell stated, “We have the tools to address inflation and we will use them to ensure price stability.”

Market Reactions

The market’s reaction to Powell’s announcements has been mixed. Following the signals of tighter monetary policy, stock markets initially experienced volatility, with investors anxious about the potential for a recession as borrowing costs rise. However, analysts noted that the long-term outlook remains cautiously optimistic, as Powell has indicated that the Fed aims to balance controlling inflation without derailing the economic recovery.

Challenges Ahead

Powell faces several challenges as he navigates the complexities of economic recovery. The impacts of global events, such as geopolitical tensions and the ongoing effects of the COVID-19 pandemic, continue to pose risks to economic stability. Additionally, rising energy prices and labour shortages further complicate the monetary landscape. The Federal Reserve will likely need to remain agile in its policy responses to these evolving challenges.

Conclusion

As Jerome Powell continues to lead the Federal Reserve, his decisions will play a crucial role in shaping the economic future of the United States. With inflation control at the forefront of his agenda, the implications of his actions will reverberate through financial markets and beyond. Observers are urged to remain attentive to Powell’s forthcoming actions, as they could significantly influence both domestic and global economic conditions in the months to come.