Understanding Inflation: Current Trends and Economic Impact

Introduction

Inflation has emerged as a pivotal concern for economies around the globe as countries continue to recover from the COVID-19 pandemic. With increasing prices affecting everything from groceries to housing, understanding the causes and implications of inflation is crucial for consumers, policymakers, and businesses alike.

The Current State of Inflation

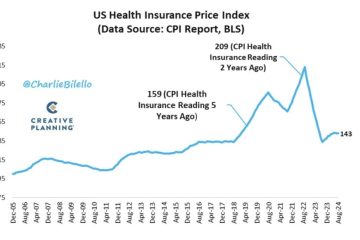

As of October 2023, inflation rates have shown significant fluctuation, with many central banks, including the Bank of England, implementing interest rate hikes in attempts to combat rising prices. The Office for National Statistics reported an inflation rate of 6.5% in August 2023, down from a peak of 11.1% in October 2022. This indicates a gradual easing of inflationary pressures, yet costs remain high for essential goods and services.

Key Contributing Factors

Several factors have contributed to the current inflation landscape. Supply chain disruptions during the pandemic have continued to impact the availability of goods, causing prices to spike. Additionally, geopolitical tensions, particularly the ongoing conflict in Ukraine, have led to increased energy and food prices, further fueling inflation. Moreover, the stimulus measures introduced by governments worldwide to support their economies have increased money supply, creating additional upward pressure on prices.

Impact on Consumers and the Economy

The ongoing inflation crisis has profound implications for consumers. Families are now facing higher costs of living, which can lead to reduced discretionary spending and increased debt. As prices climb, many are compelled to reassess their budgets and spending habits. For businesses, inflation presents challenges in managing costs while trying to maintain profitability. Additionally, persistent inflation can erode consumer confidence, potentially stalling economic growth.

Conclusion

As we move into the latter part of 2023, the future of inflation remains uncertain. While recent data suggests potential relief for consumers, economists warn that underlying issues persist. Central banks must balance the need to curb inflation with the risk of triggering a recession. The implications of sustained inflation are significant, affecting everything from personal finance to overall economic stability. Observing how these trends evolve will be crucial for stakeholders at all levels, making it an essential topic of discussion as we head into the new year.