Understanding Inflation and Its Impact

Introduction: Why inflation matters

Inflation is a central economic concept that affects the cost of living, business planning and public policy. Its relevance touches households, employers and governments because changes in inflation influence purchasing power, interest rates and fiscal decisions. Understanding inflation helps readers make informed choices about spending, saving and borrowing.

What is inflation?

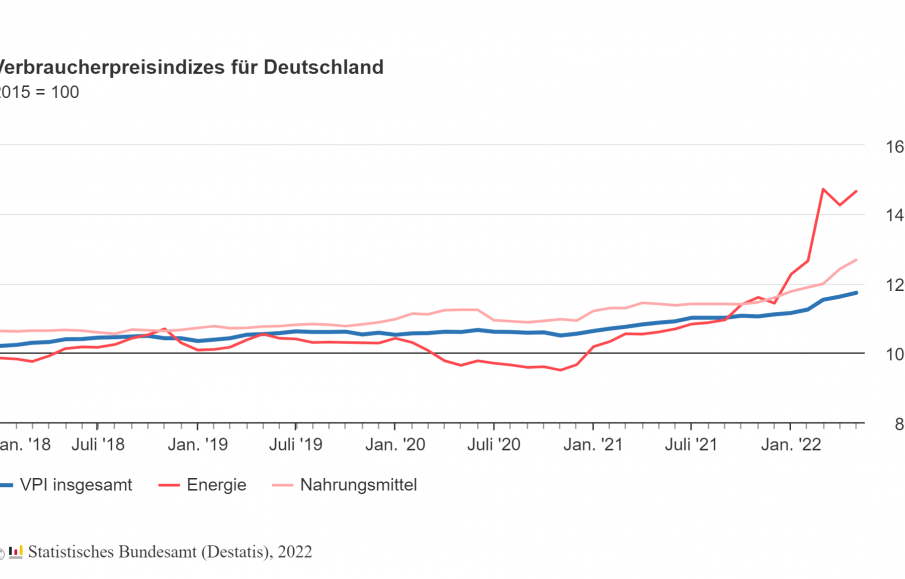

Inflation is the sustained rise in general price levels over time, meaning a unit of currency buys fewer goods and services than before. Economists measure inflation using price indices that track baskets of goods and services. While moderate inflation is normal in growing economies, persistently high inflation or rapid deflation can create economic instability.

Common causes

Inflation can arise from several sources. Demand-pull inflation occurs when aggregate demand outpaces supply. Cost-push inflation happens when production costs rise—such as wages or energy—leading firms to raise prices. Inflation expectations can also be self-reinforcing: if businesses and consumers expect higher future inflation, they may adjust prices and wages accordingly, sustaining inflationary pressures.

Effects on households and businesses

For households, inflation erodes real income unless wages rise at a similar pace. Savers may see the real value of deposits fall if interest rates do not keep up with inflation. Businesses face uncertainty that can complicate investment and pricing decisions; some firms may pass higher costs to consumers, while others absorb costs to remain competitive.

Policy responses

Central banks typically use monetary policy—most commonly adjusting short-term interest rates—to influence inflation. Raising rates can cool demand and help lower inflation, while cutting rates can support growth when inflation is low. Governments may use fiscal measures, such as targeted support for vulnerable groups, to reduce the short-term burden of price rises. Clear communication by policymakers is important to anchor inflation expectations.

Conclusion: What readers should take away

Inflation is a persistent feature of modern economies with wide-ranging implications. Monitoring price changes and understanding policy responses can help individuals and businesses manage risks to income, savings and investment. While tools exist to control inflation, outcomes depend on complex interactions between demand, supply and expectations, making vigilance and adaptive planning essential.