Understanding HMRC Tax Free Allowance in the UK

Introduction

The HMRC tax free allowance is an important aspect of personal finance for millions of UK taxpayers. Understanding this allowance can significantly impact individuals’ savings and tax liabilities. The tax free allowance, formally known as the Personal Allowance, is the amount individuals can earn without having to pay income tax. As the tax landscape evolves, updates regarding the allowance are critical for ensuring taxpayers can better manage their finances.

What is the HMRC Tax Free Allowance?

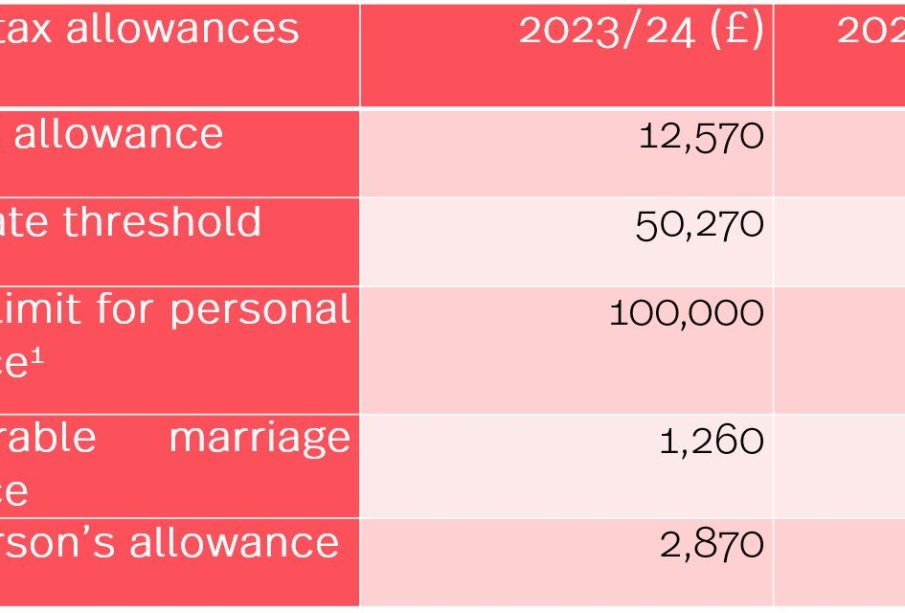

The Personal Allowance for the 2023/24 tax year is £12,570 for individuals earning up to £100,000. For those earning above this threshold, the allowance gradually decreases by £1 for every £2 earned over £100,000, which effectively means that individuals earning £125,140 or more will receive no Personal Allowance. This allowance is crucial as it effectively allows individuals to keep a greater portion of their income while paying taxes only on earnings above this level.

How Does It Affect Taxpayers?

For many taxpayers, understanding the Personal Allowance can lead to significant savings. For example, an individual earning £30,000 will only pay tax on £17,430 of their income after accounting for the allowance. Given the current income tax rates, this can result in a substantial reduction of overall tax liability. Additionally, taxpayers can benefit from the tax-free savings through ISAs (Individual Savings Accounts), dividends allowances, and other tax-efficient strategies that complement the Personal Allowance.

Recent Changes and Considerations

The HMRC frequently reviews tax policies, and any changes to the Personal Allowance can affect the financial planning of UK taxpayers. For instance, in recent budgets, the government has remained committed to maintaining the allowance at its current level amid rising inflation and cost of living pressures. This stability provides a sense of predictability for taxpayers but requires active monitoring for any adjustments in future budgets. Furthermore, individuals should also be aware of potential tax implications arising from side incomes, which could affect their allowance depending on total earnings.

Conclusion

In conclusion, the HMRC tax free allowance is a fundamental component of the UK tax system that provides necessary financial relief to taxpayers. By staying informed about potential changes and understanding how this allowance interacts with other income sources, individuals can make strategic decisions that enhance their financial well-being. It is advisable for UK taxpayers to consult financial advisors or use official HMRC resources for personalised guidance to optimise their tax positions and ensure compliance.