Understanding Hims Stock: Performance and Future Prospects

Introduction

The performance of Hims stock has garnered significant attention in recent years due to the rising interest in telehealth and wellness services. As a company that operates in the digital health space, Hims & Hers Health, Inc. offers a range of services from telemedicine consultations to prescription medications and wellness products. This relevance has intensified in 2023, as investors seek to understand the company’s market position and future potential amidst evolving industry dynamics.

Current Market Trends

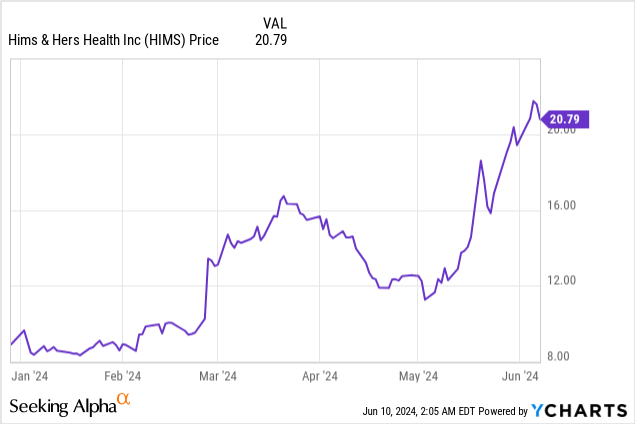

As of October 2023, Hims stock has experienced fluctuations largely influenced by broader market trends, changing consumer behaviors, and competition within the telehealth sector. According to recent reports, Hims stock was trading around $6.50, having shown resilience following a dip earlier in the year. The company reported a year-on-year revenue growth of 22%, highlighting a shift in consumer preference towards online health solutions, especially post-pandemic.

Key Developments

In the second quarter of 2023, Hims unveiled new products aimed at mental health and sexual wellness, aligning with growing public focus on holistic health approaches. This strategic expansion is expected to attract more customers, diversifying its revenue streams. Furthermore, the company announced partnerships with major retail chains to expand its reach, indicating a proactive approach to solidify its market position.

Financial Analysis

Analysts have provided mixed forecasts for Hims stock. While some experts express optimism regarding the company’s growth trajectory and potential market share, others caution about the competitive pressures from emerging telehealth firms. The price-to-earnings ratio currently sits at a moderate level, suggesting the stock is valued fairly based on earnings projections. Investors are advised to monitor quarterly earnings reports closely, as they will provide insights into ongoing performance and operational efficiencies.

Conclusion

The performance of Hims stock will continue to be influenced by several factors including market dynamics, consumer trends, and corporate strategies. As telehealth solutions become increasingly integral to everyday health management, the company’s ability to innovate and adapt will be crucial for long-term success. For investors, understanding the complexities of Hims’ operational model will provide valuable insights. As forecasts remain cautiously optimistic, it remains vital for stakeholders to keep abreast of industry developments and Hims’ strategic initiatives as we move towards 2024.