Understanding FTSE 100 Share Price Trends and Factors

Introduction to FTSE 100 Share Prices

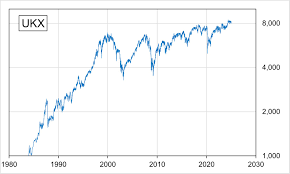

The FTSE 100 index, comprising the 100 largest companies listed on the London Stock Exchange, serves as a barometer for the UK’s economy and stock market health. Investors closely monitor the FTSE 100 share price, as it reflects the performance of major industries and companies, influencing investment decisions and market sentiment. Understanding the dynamics of the FTSE 100 share price is essential for stakeholders, investors, and analysts.

Current Trends and Market Conditions

As of October 2023, the FTSE 100 share price has experienced significant volatility attributed to multiple factors, including geopolitical tensions, inflation rates, and changes in monetary policy. Over the past month, concerns regarding the UK’s economic recovery amid rising energy prices and ongoing supply chain disruptions have impacted market confidence.

Recent trading sessions have shown the FTSE 100 fluctuating around the 7,200 to 7,400 points range. Analysts predict that the index could face further challenges as the Bank of England continues to navigate interest rate adjustments amidst persistent inflationary pressures. The latest figures indicate that inflation is still hovering above the target, leading to heightened scrutiny of consumer spending patterns which are paramount for UK corporations.

Key Influencers on Share Price Movements

Several key sectors heavily influence the performance of the FTSE 100 share price. The financial sector, which includes banks and insurance companies, experiences direct impacts from interest rate changes. The energy sector is also significant, particularly as global oil prices remain volatile due to geopolitical tensions, affecting companies like BP and Shell.

Additionally, companies that rely on exports are facing challenges from fluctuations in currency exchange rates. The strength of the British Pound against other currencies impacts how much UK goods cost abroad, which can subsequently influence company earnings and share prices.

Conclusion and Future Outlook

As we progress into the last quarter of 2023, the FTSE 100 share price remains a reflection of both local and international economic sentiments. The market is expected to react dynamically to updates on inflation, interest rate adjustments, and global economic conditions. Stakeholders should remain vigilant and informed, as changes in these areas could significantly impact investment environments and share valuations.

Overall, the forecast remains cautious, with a potential for both recovery and further downturns in the near term. Investors are advised to adopt a diversified approach to mitigate risks associated with fluctuations in the FTSE 100 share price.