Understanding Fixed Mortgage Rates and Their Importance

Introduction

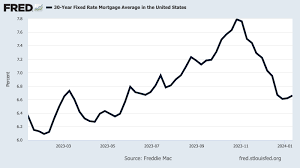

Fixed mortgage rates are a critical aspect of the home buying process, significantly influencing affordability and financial planning for mortgage borrowers. With the fluctuation of interest rates seen in recent months, understanding how fixed mortgage rates operate and their implications is more important than ever for potential homebuyers.

What are Fixed Mortgage Rates?

Fixed mortgage rates refer to a type of mortgage where the interest rate remains constant throughout the duration of the loan. This offers homeowners the security of knowing exactly what their monthly payments will be, eliminating surprises and helping with long-term budgeting.

Current Market Trends

As of October 2023, fixed mortgage rates in the UK have been on a slight upward trend. According to the Bank of England, the average interest rate for a two-year fixed mortgage has risen to approximately 5.2%, while the five-year fixed mortgage rate has reached about 4.9%. These increases reflect the overall rise in interest rates as the Bank of England seeks to combat inflation.

Impact on Homebuyers

The current environment of rising fixed mortgage rates has led to several implications for homebuyers. Firstly, buyers are advised to lock in a mortgage rate sooner rather than later, as rates may continue to climb. Secondly, higher fixed mortgage rates mean less borrowing power, which could deter first-time buyers and those with tighter budgets from entering the housing market.

According to a recent report from the National Association of Estate Agents (NAEA), the number of potential buyers registering with estate agents has declined by 15% in the past year, largely attributed to the increased cost of borrowing. This could lead to a slowdown in the housing market as demand decreases in the face of more expensive mortgages.

Conclusions and Future Forecasts

In summary, as fixed mortgage rates continue to rise, it’s essential for prospective homebuyers to stay informed and evaluate their options. Experts predict that the market may stabilise after this fluctuating period, potentially leading to more competitive rates in mid to late 2024. Homebuyers should consider seeking expert advice and perhaps exploring alternative mortgage products that may offer more flexibility and potentially lower rates.

Ultimately, having a solid understanding of fixed mortgage rates is crucial for anyone looking to purchase a home, as it directly impacts their financial well-being and long-term commitments in the property market.