Understanding Ethereum Price Trends and Future Predictions

Introduction

The price of Ethereum has taken the cryptocurrency market by storm in recent years, becoming a focal point for investors and enthusiasts alike. As the second-largest cryptocurrency by market capitalisation, Ethereum’s price movements are closely monitored for their potential to influence trends across the entire digital asset landscape. Understanding these price trends is vital for investors seeking to navigate the unpredictable nature of cryptocurrencies.

Current Price Trends

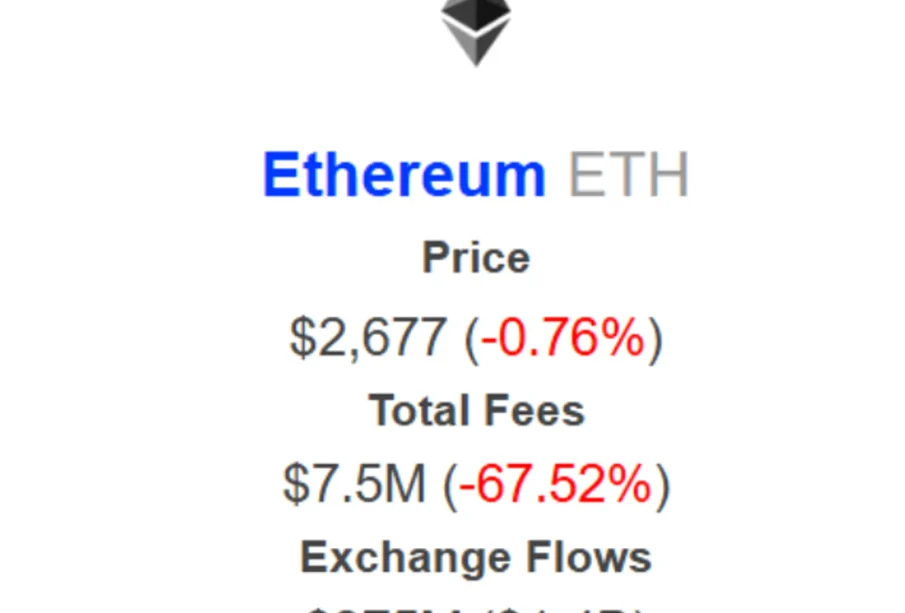

As of late October 2023, Ethereum is experiencing significant fluctuations in its price, currently hovering around £1,600. This represents a notable increase of approximately 25% from its low earlier this year when it fell to about £1,280. The overall market sentiment has improved, following a broader recovery in the cryptocurrency markets after several months of bearish trends.

One of the major contributing factors to the recent price surge is the increasing adoption of Ethereum’s smart contract capabilities, enabling various DeFi (decentralised finance) applications to thrive. Additionally, the upcoming Ethereum 2.0 upgrades are anticipated to improve transaction efficiency and scalability, further supporting the bullish trend.

Market Influences

The Ethereum price is highly influenced by external factors, including regulatory changes, market sentiment, and technological advancements. Recently, increased institutional investment has provided a boost to market confidence. Major corporations are beginning to embrace cryptocurrencies, and as they incorporate blockchain technology, Ethereum stands to gain immensely.

Moreover, the global macroeconomic environment, including inflation rates and central bank policies, continues to play a pivotal role in shaping investor behaviour towards riskier assets like cryptocurrencies. As traditional financial markets react, so too does Ethereum, often mirroring trends seen in the stock market.

Future Price Predictions

Looking ahead, analysts remain optimistic about Ethereum’s potential price trajectory. A report by industry experts suggests that Ethereum could reach between £2,000 to £2,500 by the end of 2024, assuming current growth patterns continue and broader market conditions remain favourable. The predicted price is driven not only by increased adoption and diversification of use cases but also by the hard cap on Ethereum’s issuance stemming from the recent transition to a proof-of-stake model.

Conclusion

The Ethereum price remains a significant topic within the financial zeitgeist, reflecting broader trends within the cryptocurrency markets. For investors considering diversifying their portfolios into digital assets, understanding the factors influencing Ethereum’s price can be vital in making informed decisions. As the landscape evolves, keeping an eye on regulatory developments, technological innovations, and market sentiment may provide clarity in navigating future price movements. The potential for further gains remains promising in the coming months and years.