Understanding Current Mortgage Rates in the UK

Introduction

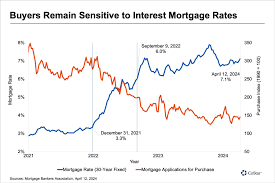

Mortgage rates are a critical factor for homebuyers and the property market, influencing affordability and purchasing decisions. Recent fluctuations in interest rates have sparked discussions among potential buyers and homeowners looking to remortgage. Understanding current mortgage rate trends is essential for those looking to make informed financial decisions in a potentially volatile economic climate.

Current Mortgage Rate Trends

As of October 2023, mortgage rates in the UK have been experiencing a significant increase. According to data from the Bank of England, the average rate for a two-year fixed mortgage rose to 5.56%, up from 5.22% just a month ago. Similarly, the average rate for a five-year fixed mortgage has climbed to 5.32%, showing a consistent upward trend over recent months.

This increase has been attributed to the Bank of England’s efforts to tackle inflation, which remains above target levels. With the base rate currently at 5.25%, lenders are adjusting their mortgage products accordingly, leading to higher rates for consumers. For many, this means higher monthly repayments, which can deter first-time buyers and those looking to move up the property ladder.

Impact on Homebuyers and the Housing Market

The rising mortgage rates have notable implications for the housing market. According to the latest figures from the UK House Price Index, property prices have begun to stabilise; however, a slowdown in buyer activity is evident as affordability shrinks. First-time buyers, who often rely on fixed-rate deals to navigate the property market, are particularly affected. Many are reassessing their budgets and timelines for purchasing a home.

Additionally, real estate analysts warn that sustained high mortgage rates could lead to a cooling of the housing market, with fewer transactions taking place as buyers receive less favourable borrowing terms. This scenario could potentially lead to stagnation in property price growth, reflecting a change from the rapid appreciation seen during the pandemic.

Conclusion

In summary, the current rise in mortgage rates signifies a challenging landscape for homebuyers in the UK. As inflationary pressures continue to shape the economic environment, potential homebuyers must stay informed and consider their options carefully. With forecasts indicating that the Bank of England may continue to adjust the base rate, the mortgage market will likely remain in flux. Understanding these dynamics is essential for anyone looking to navigate homeownership in today’s economic climate.