Understanding Current Mortgage Rates and Trends

The Importance of Mortgage Rates

Mortgage rates play a crucial role in the housing market, significantly influencing the affordability of homeownership for many individuals. As the economy fluctuates and inflation affects the markets, understanding the trends in mortgage rates can assist potential buyers and homeowners in making informed financial decisions.

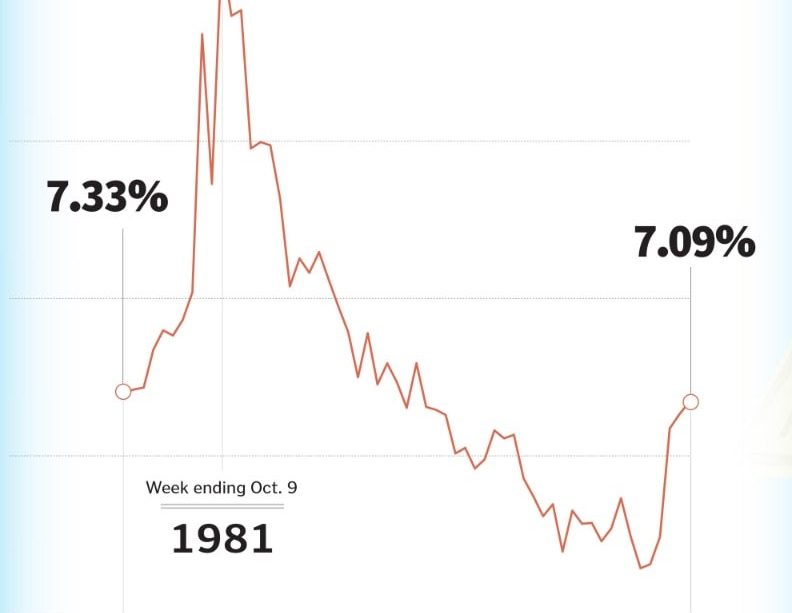

Recent Trends in Mortgage Rates

As of October 2023, mortgage rates have seen a notable rise attributed to the Bank of England’s recent decisions amid ongoing economic uncertainties. The average rate for a 30-year fixed mortgage is currently hovering around 6.5%, with some lenders offering slightly lower rates depending on the borrower’s creditworthiness and financial profile. This marks a considerable increase from the previous year when rates were below 3%. The sudden spike is primarily driven by inflation surges and the central bank’s efforts to curb rising prices.

Impact on Homebuyers

The increase in mortgage rates has affected homebuyer sentiment, leading to a slowdown in property sales across the UK. Prospective buyers are now facing higher monthly repayments, which could deter many from entering the market. According to the latest reports from the Royal Institution of Chartered Surveyors (RICS), a significant number of buyers have either postponed their purchasing plans or scaled down their expectations regarding property values. Additionally, first-time buyers are finding it particularly challenging as higher rates decrease their purchasing power.

What Experts Are Saying

Experts predict that mortgage rates may continue to fluctuate in the near term as the Bank of England navigates its monetary policy in response to ongoing economic challenges. Analysts suggest that potential buyers should keep a close watch on market indicators and consider locking in rates as soon as they find a favourable option, given the possibility of further increases in the future.

Conclusion

In conclusion, the current landscape of mortgage rates presents both challenges and opportunities for prospective homeowners and those looking to refinance. Keeping abreast of these trends will be crucial as the housing market reacts to economic changes. Those ready to navigate this complex environment with due diligence may still find suitable options within their reach, despite the prevailing uncertainties. Understanding your financial situation and consulting with a mortgage advisor could pave the way for more informed decisions in this fluctuating market.