Understanding Current Gold Price Trends

The Importance of Gold Price Monitoring

Gold has traditionally been viewed as a safe-haven asset, particularly during periods of economic uncertainty. With the ongoing shifts in global markets, tracking the price of gold becomes increasingly important for investors, businesses, and consumers alike. The gold price not only reflects investors’ confidence but also has implications for inflation, currency values, and global demand.

Recent Trends in Gold Prices

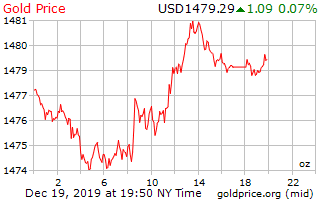

As of October 2023, gold prices have experienced significant fluctuations due to various factors, including central bank policies, geopolitical tensions, and shifts in investor sentiment. According to data from the London Bullion Market Association, gold was priced at approximately £1,780 per ounce at the beginning of the month, marking a slight increase from September.

Market analysts have noted that the rise in gold prices can be attributed to investors seeking refuge from volatile stock markets and rising fears of inflation. The Bank of England’s recent decision to maintain low interest rates, in the wake of economic recovery from the pandemic, has also bolstered interest in gold as a hedge against potential currency depreciation.

Global Factors Influencing Gold Prices

Several key factors contribute to the fluctuations in gold prices:

- Geopolitical Tensions: Heightened tensions in regions like Eastern Europe and the South China Sea have prompted investors to turn towards gold as a safe-haven asset.

- Inflation Rates: With inflation rates rising in various economies, including the UK, gold is often seen as a hedge against decreasing purchasing power.

- Central Bank Policies: Changes in interest rates and quantitative easing measures taken by central banks around the world significantly impact gold’s attractiveness.

Conclusion: Looking Ahead

As we move further into the latter part of 2023, expert forecasts suggest that gold prices may continue to rise, particularly if economic indicators point to uncertainty. Investors and consumers alike should remain vigilant and informed about market trends as these factors develop. Understanding the underlying reasons for changes in gold prices can arm individuals and businesses with the knowledge needed to make sound financial decisions in an unpredictable economic environment.