Understanding Council Tax: What You Need to Know

Introduction

Council tax is a crucial aspect of local government funding in the United Kingdom, impacting millions of households. Established in 1993, it serves as a means to finance essential local services such as waste collection, policing, and education. Recent discussions around council tax have brought the topic back into the public eye, making it increasingly important for citizens to understand their responsibilities and the implications of this tax.

Current Developments

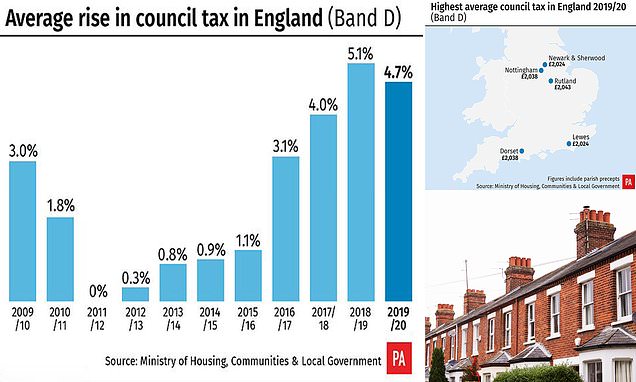

As of 2023, council tax rates have seen significant adjustments across various regions in England, Scotland, Wales, and Northern Ireland. Many councils have raised their rates to cope with escalating costs and budget deficits, prompting concerns about affordability among residents. According to a recent report by the Ministry for Housing, Communities & Local Government, around 36% of local authorities are increasing their council tax rates by the maximum amount permitted, which is often capped at 5% for council tax levels.

In some areas like London, boroughs are facing unique challenges. For example, London Councils data indicates that certain boroughs are considering banding changes to adjust for inflation and the rising cost of living. Meanwhile, discussions are ongoing around potential reforms to the council tax system, including the possibility of a local income tax to replace the current system, as suggested by various advocacy groups.

Challenges and Implications

The affordability of council tax has become a pressing issue, particularly for vulnerable individuals and low-income families. A recent study from the Joseph Rowntree Foundation highlights that the financial burden of council tax is disproportionately felt by those on lower incomes. To mitigate this, some councils have implemented discretionary schemes to support residents struggling to pay their tax bills.

Conclusion

As the government continues to navigate through fiscal challenges, the future of council tax remains uncertain. Residents should stay informed about potential changes in rates and policies that could affect their bills. Advocacy from community groups will be essential in shaping any upcoming reforms, aiming to ensure that the council tax system is fair and equitable for all citizens. As trends indicate that council tax will remained firmly in the spotlight, keeping abreast of developments is crucial for homeowners, tenants, and council taxpayers across the UK.