Understanding Bitcoin USD: Price Drivers, Risks and How to Track It

Introduction

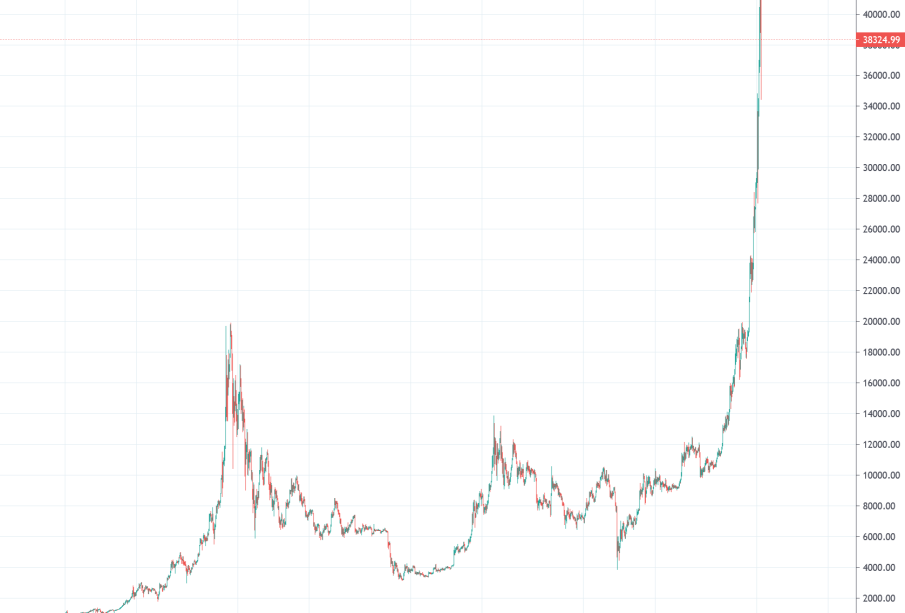

Bitcoin USD is the most widely cited trading pair for the cryptocurrency bitcoin, showing its value denominated in US dollars. Its importance lies in providing a common reference point for investors, traders and the broader public to understand bitcoin’s market value. As cryptocurrencies have become more integrated with global finance, the bitcoin USD rate is often used as a barometer of market sentiment, liquidity and the health of the crypto ecosystem.

Main body

What bitcoin USD represents

The bitcoin USD quote reflects the price at which market participants are willing to buy and sell bitcoin for US dollars on exchanges. Multiple venues publish prices, and those quotes can vary slightly due to differences in liquidity, trading volume and fees. Major exchanges and aggregated indices are commonly used to obtain a representative price.

Key drivers of the rate

Several factors typically influence the bitcoin USD rate. Market sentiment and investor demand are primary drivers, as are changes in regulatory environments, macroeconomic conditions and developments within the crypto sector such as protocol upgrades or security incidents. Liquidity on major trading platforms and flows from institutional investors can also amplify price movements.

How to track bitcoin USD

Individuals track the bitcoin USD price through exchange platforms, financial news sites, price aggregators and broker services. For trading or valuation purposes, many users prefer to consult consolidated indices that aggregate prices across reputable exchanges to reduce the impact of outliers and exchange-specific spreads.

Risks and considerations

Bitcoin is known for its price volatility, and the bitcoin USD rate can change rapidly. Traders should be aware of market risks, counterparty risk when using exchanges, and the potential for sudden regulatory or technical events to affect prices. Diversification, risk management strategies and understanding fee structures are important when engaging with the market.

Conclusion

Bitcoin USD remains the central reference for assessing bitcoin’s value in fiat terms. For readers, staying informed about market conditions, using reliable price sources and applying prudent risk management will be key to navigating the bitcoin USD market. While future movements are uncertain, the pair will continue to be essential for price discovery and decision-making in the crypto space.