Understanding Barclays Share Price Movements

Introduction

The Barclays share price has garnered significant attention in the financial world, reflecting the bank’s performance and the broader economic landscape. As one of the UK’s leading financial institutions, Barclays plays a critical role in the national and global economy. Its share price is influenced by various factors, including economic data, investor sentiment, and regulatory changes. Understanding these dynamics is essential for investors and analysts alike.

Current State of Barclays Share Price

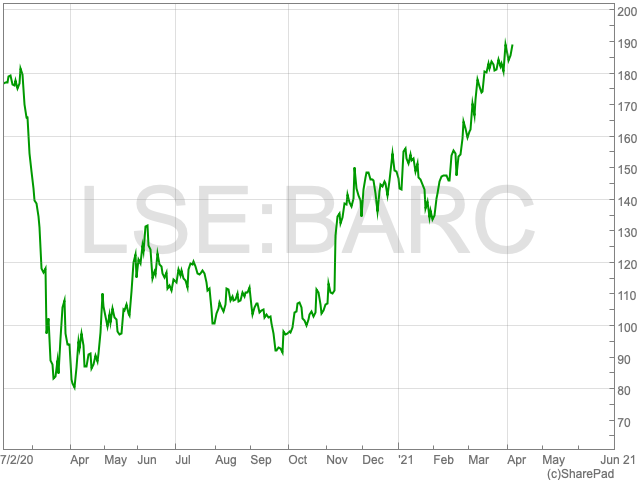

As of October 2023, the Barclays share price has experienced fluctuations that can be attributed to a combination of market conditions and internal corporate developments. Recent data indicates that the share price hovers around £1.20, reflecting a modest recovery from a lower point earlier in the year. Portfolio managers are closely monitoring these movements as they assess the bank’s profitability in an evolving economic environment.

Factors Influencing Share Price

Several key factors have impacted the Barclays share price:

- Interest Rates: As interest rates rise, banks typically benefit from increased net interest margins. However, the recent fluctuations in anticipated interest rate changes have created uncertainty about profitability.

- Regulatory Environment: The UK banking sector is under scrutiny, and regulatory changes may affect banks’ operational costs and profitability. Any announcements of new regulations can lead to immediate market reactions.

- Economic Indicators: Macroeconomic conditions such as inflation rates, employment figures, and economic growth indicators heavily influence investor confidence.

- Corporate Strategy: Barclays’ strategic decisions, including investments in technology and cost-cutting measures, play an essential role in shaping investor perceptions and ultimately the share price.

Market Sentiment and Future Outlook

Analysts remain mixed in their outlook for Barclays. While some predict a bullish trend if economic indicators show improvement, others caution against potential downturns due to geopolitical risks and market volatility. Investor sentiment, amplified by both global and domestic events, continues to create an atmosphere of uncertainty surrounding Barclays’ future performance.

Conclusion

In summary, monitoring the Barclays share price is crucial for investors looking to navigate the complexities of modern banking. Understanding the interplay of various economic factors, corporate strategies, and market sentiment will help investors make informed decisions. As Barclays continues to adapt to changing circumstances, its share price will remain a barometer for its overall health and broader financial stability in the UK.