Understanding Barclays Share Price: Current Trends and Insights

Introduction

The Barclays share price has been a critical indicator of the bank’s financial health and market confidence. As one of the UK’s leading financial institutions, changes in its share price can significantly affect investor sentiment, market volatility, and even broader economic conditions. Understanding the dynamics behind the Barclays share price is essential for stakeholders, including investors, analysts, and market watchers.

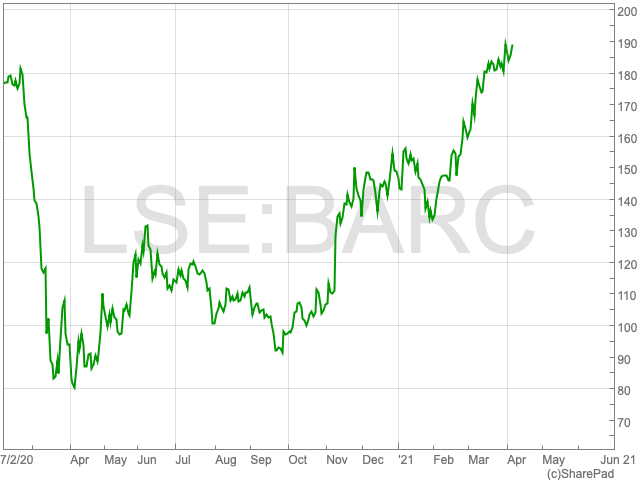

Recent Performance

As of October 2023, Barclays shares have experienced notable fluctuations, primarily influenced by external economic factors and internal performance metrics. Recent reports indicate that the Barclays share price has seen a rise of approximately 5% over the last month, with shares currently trading around £1.50. This uptick has been attributed to a strong quarterly earnings report, where Barclays exceeded analysts’ expectations, reporting a net income increase of 15% year-on-year.

Market Influences

Several key factors have contributed to the current state of the Barclays share price. Firstly, changes in interest rates by the Bank of England and inflationary pressures have set the backdrop for banking sector performance. The bank’s proactive measures in managing its operational costs and enhancing its digital services have also played a vital role in reinforcing investor confidence.

Moreover, Barclays has been focusing on expanding its investment banking division, which performed particularly well amidst increased market activity. Analysts suggest that this diversification strategy may bolster the bank’s resilience, making it a more attractive option for investors looking for stability in uncertain environments.

Outlook and Forecast

Looking ahead, experts predict that Barclays share price may continue to exhibit volatility in response to upcoming economic indicators and regulatory changes. While some analysts remain cautiously optimistic, forecasting a gradual uptick in the share price as the bank continues to navigate the complex financial landscape, others warn of potential risks stemming from geopolitical tensions and market corrections.

In conclusion, the Barclays share price remains a focal point for understanding the bank’s overall performance and the broader financial market’s sentiment. Investors are encouraged to stay informed about developments affecting both the bank and the economic environment to make educated decisions regarding their investments.