Understanding Barclays Mortgage Rates in 2023

The Importance of Mortgage Rates

In the current economic climate, mortgage rates play a significant role in determining home affordability for many individuals. With the fluctuating interest rates, potential home buyers are increasingly focused on finding the most competitive mortgage offers available. Barclays, a leading UK bank, has recently adjusted its mortgage rates, making it crucial for consumers to stay informed.

Current Rates Offered by Barclays

As of October 2023, Barclays has revised its mortgage rates in response to changes in the economic landscape. The interest rates for fixed-rate mortgages start at an annual percentage rate (APR) of 4.49% for a two-year fixed deal. For those seeking longer-term security, their five-year fixed mortgages begin at an APR of 4.99%. Additionally, the bank has introduced new options for first-time buyers and those looking to remortgage, with specific products tailored to meet varying financial needs.

Market Context and Future Predictions

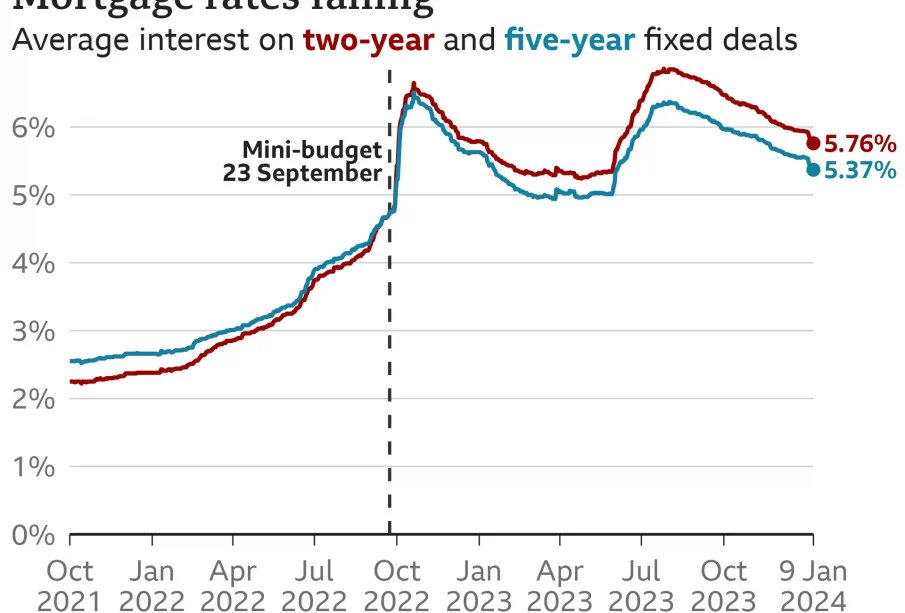

The changes in Barclays’ mortgage rates reflect broader trends seen across the UK mortgage market, where lenders are adjusting their offers based on the Bank of England’s base rate and economic forecasts. According to analysts, while rates are currently stabilising, the ongoing effects of inflation could lead to further rate adjustments in the coming months. Homebuyers and prospective remortgagers may need to be prepared for potential fluctuations as economic conditions evolve.

How to Choose the Right Mortgage

When considering a mortgage, it is essential to assess not only the interest rate but also the features of the mortgage product, including repayment terms, fees, and flexibility. Barclays, like many lenders, offers a variety of tools and resources online to help borrowers understand their options. Consulting with a financial advisor can also provide clarity on the best mortgage option tailored to individual financial circumstances.

Conclusion

The current Barclays mortgage rates present both challenges and opportunities for homebuyers in 2023. Staying informed about changes in rates and understanding the implications on affordability is crucial. As the market continues to fluctuate, it’s advisable for consumers to compare several mortgage products and seek professional guidance to make informed decisions about their home financing.