UK State Pension Triple Lock Delivers 4.1% Boost: What This Means for Pensioners in 2025

Pension Boost Secured for Millions

Millions of British pensioners are set to receive up to £470 more annually in their State Pension payments, following the government’s commitment to maintain the pension Triple Lock policy.

The Triple Lock mechanism, which guarantees that State Pension increases annually by the highest of inflation, average earnings growth, or 2.5%, has resulted in a 4.1% rise, surpassing current inflation levels.

New Payment Rates

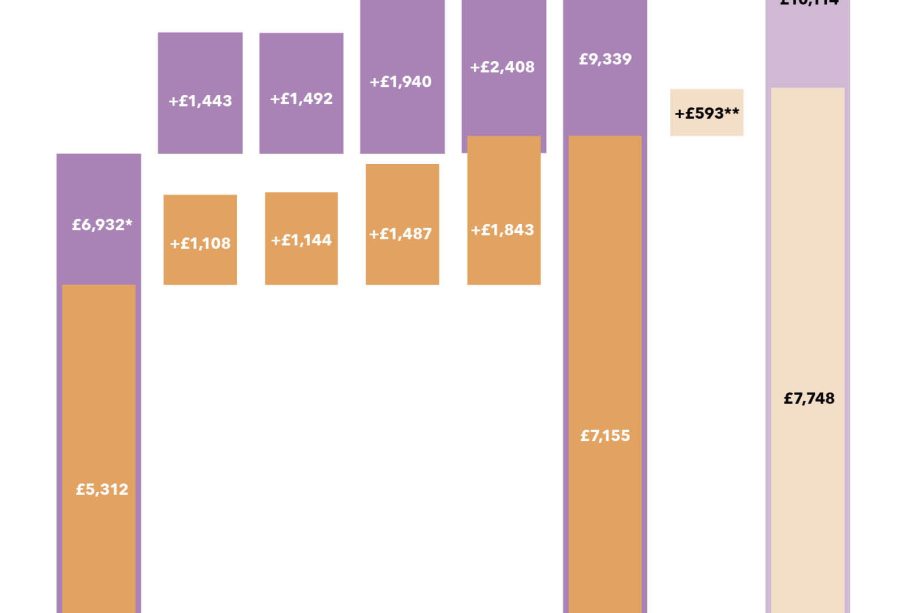

The full State Pension has been set at £230.25 per week, or £11,973 annually, for the 2025/26 tax year. This represents a significant increase from previous years, having risen more than 24% in three years.

For those receiving the new State Pension, this marks an increase from £221.20 per week in 2024/25. To qualify for the full amount, individuals need 35 qualifying years of National Insurance contributions. Recipients of the basic State Pension will see their payments rise to £176.45 per week.

Future Sustainability and Challenges

Looking ahead, the Department for Work and Pensions forecasts State Pension expenditure to reach £169 billion by 2029-30, representing a 16% increase in nominal terms compared to 2025-26, or an 8% rise when accounting for inflation.

The cost of State Pensions as a proportion of GDP has seen significant changes since the 1990s. While costs were previously offset by slower growth in average pension awards, the introduction of the Triple Lock, combined with slower GDP growth and increasing pensioner numbers, has led to rising costs.

Additional Support Measures

The government maintains that this commitment centers around providing dignity and security to those who have worked throughout their lives. The Triple Locked State Pension remains a cornerstone of this commitment, with additional support through Pension Credit, which provides supplementary assistance for low-income pensioners with average awards worth over £3,900.

However, experts note that even with these increases, the full State Pension of £11,973 falls below the £14,400 annually needed for a ‘minimum’ retirement lifestyle. The amount received depends on National Insurance contributions, and individuals can check their personal records and State Pension forecast through government websites.