The Transformative Influence of Robinhood on Trading

Introduction

In the ever-evolving world of finance, Robinhood has emerged as a significant player, revolutionising how individuals engage with stock trading. Launched in 2013, Robinhood’s user-friendly mobile app has removed barriers to entry for millions, allowing novice investors to trade without paying commission fees. This not only democratizes access to financial markets but also sparks discussions around investment strategies, market volatility, and financial literacy.

Key Developments

Recently, Robinhood has expanded its offerings beyond commission-free trading for stocks and ETFs to include cryptocurrencies, options trading, and cash management services. As of October 2023, the platform boasts over 31 million users, showcasing its rapid growth and the increasing appetite for retail trading. In response to concerns over trading practices during market volatility—such as the GameStop phenomenon earlier in 2021—Robinhood has made a commitment to enhance transparency and customer education.

Robinhood has also faced scrutiny regarding liquidity and trading restrictions. The company temporarily restricted trading in several stocks during periods of high volatility, leading to accusations of market manipulation. In September 2023, Robinhood reached a settlement with the Securities and Exchange Commission (SEC) over allegations of misleading customers about its revenue sources. The implications of these actions resonate throughout the retail trading community, prompting discussions on the ethics of fintech in today’s digital economy.

Broader Implications for Investors

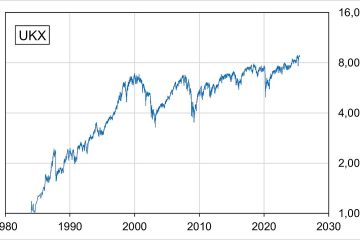

The rise of Robinhood has significantly altered the investing landscape. Traditional brokerage firms are now compelled to adapt to the demand for lower costs and more accessible platforms. As users gravitate towards mobile trading, seasoned investors are reconsidering their strategies to accommodate the influx of retail traders driving price fluctuations in various stocks.

Furthermore, the interaction between retail investors and institutional investors is evolving. The advent of social media platforms like Reddit and Twitter has given retail investors a powerful voice, capable of influencing stock prices and market trends. This shift has led to a more dynamic market environment, but also instigated discussions about market stability and the potential for speculative bubbles.

Conclusion

The significance of Robinhood in the financial sector cannot be overstated. As it continues to innovate and address emerging challenges, it provides an invaluable case study for the intersection of technology, finance, and consumer behaviour. The overall impact of Robinhood on retail investing will likely shape the future of how investors approach markets, driving further innovation and potentially recalibrating the balance of power between institutional and retail investors. The coming years will determine the long-term implications of Robinhood’s model and its effects on market dynamics.