The State Pension in the UK: Updates and Changes for 2023

Introduction

The State Pension is a crucial element of the UK’s welfare system, providing financial support to retirees. As millions rely on this income in their later years, understanding its structure, changes, and future implications is vital. With recent reforms and rising living costs affecting pensioners, 2023 presents significant developments that warrant attention.

Recent Changes to the State Pension

In April 2023, the UK government implemented an increase in the State Pension rates. The basic State Pension rose to £141.85 per week, and the new State Pension reached £203.85 per week. This adjustment follows the government’s commitment to the triple lock policy, which ensures that the pension amount increases in line with inflation, wage growth, or by 2.5%, whichever is highest. However, inflation rates soared in 2022, leading to concerns about the sustainability of this system.

Impact of Inflation on Pensioners

The ongoing cost-of-living crisis has brought significant challenges to retirees relying on the State Pension for their livelihood. While the increase is aimed at alleviating some financial pressure, recent high inflation rates have eroded purchasing power, making it difficult for many pensioners to afford everyday essentials. The Office for National Statistics reported that inflation peaked at over 10% in 2022, leading to rising food and energy prices that disproportionately affect older individuals.

Future of the State Pension

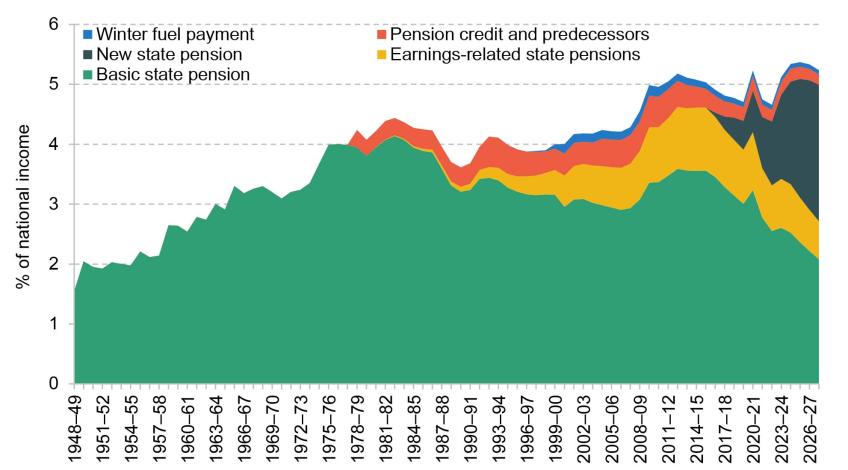

Looking ahead, experts warn that the sustainability of the State Pension system could be at risk. Demographic changes, including an ageing population and increasing life expectancy, place additional strain on the welfare system. The government is being urged to reevaluate pensions policy to ensure it meets future demands without compromising support for vulnerable older citizens.

Conclusion

As we move through 2023, it remains critical for those approaching retirement and current pensioners to stay informed about State Pension changes and their implications. While recent adjustments have provided some relief, the broader economic context raises questions about the future viability of the pension system. Individuals should consider seeking financial advice to navigate their retirement planning in light of these developments. The discussions surrounding the State Pension will likely continue as the government assesses ongoing challenges and considers reforms aimed at ensuring a secure financial future for all retirees.