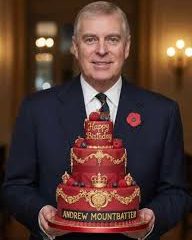

The Role of Andrew Bailey in the UK Economy

Introduction

Andrew Bailey, the Governor of the Bank of England since March 2020, plays a pivotal role in shaping the UK’s economic landscape. As the face of monetary policy in the UK, his decisions impact everything from inflation rates to interest policies, making his leadership crucial in times of economic uncertainty. With rising inflation, post-pandemic recovery, and the effects of geopolitical tensions, Bailey’s actions are more relevant than ever.

Recent Developments

In recent months, Andrew Bailey has faced increasing pressures due to soaring inflation rates that have reached 10.1%, well above the Bank’s target of 2%. In a bid to combat inflation, the Bank of England raised interest rates multiple times in 2023, which has sparked conversations about the balance between controlling inflation and supporting economic growth.

During his speeches and public appearances, Bailey has emphasised the importance of taking tough decisions to curb inflation, stating, “We must act decisively to manage price stability and protect the long-term economic prospects of the UK.” However, this approach has drawn criticism from various sectors, including politicians and business leaders, who argue that high-interest rates may stifle investment and recovery.

Impact of Policies

Bailey’s tenure has not been without challenges. The continuing effects of Brexit and the energy crisis resulting from the Ukraine war are intertwining with his policies, making the economic landscape particularly volatile. The Bank of England’s predictions for inflation suggest that it will remain elevated for the foreseeable future, necessitating a delicate balance in policy making.

Furthermore, the UK government has sought to influence Bailey’s policies through its fiscal measures, indicating a tight interrelationship between monetary and fiscal policies in navigating the post-pandemic economy. Bailey’s foresight and advisory role are crucial in this context, as economic recovery must be managed alongside the challenges of inflation.

Conclusion

As Andrew Bailey continues to navigate the complexities of his role at the Bank of England, the implications of his decisions are among the most watched in the UK. The future of the UK economy remains uncertain, but Bailey’s commitment to transparency and action will be vital as he leads through these unprecedented times. Stakeholders will be keeping a keen eye on further interest rate announcements and policy shifts that may arise in the coming months, determining the public’s economic well-being and the recovery trajectory of the nation.