The Role and Influence of the Federal Reserve (Fed)

Introduction

The Federal Reserve, commonly referred to as the Fed, serves as the central bank of the United States and plays a pivotal role in shaping the country’s monetary policy. Established in 1913, the Fed is crucial in maintaining economic stability, controlling inflation, and maximising employment. Understanding the actions and decisions made by the Fed is essential for anyone interested in economics, finance, and the well-being of the global economy.

Current Economic Context

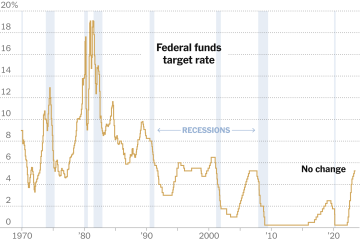

As of late 2023, the Fed has been actively engaged in adjusting its monetary policy in response to significant economic challenges including inflationary pressures and fluctuating employment rates. Following a period of heightened inflation, which surged to a 40-year high earlier this year, the Fed has implemented several interest rate hikes aimed at cooling off excessive spending and stabilising prices. The aim of these rate increases is to bring inflation back towards its target rate of 2% while fostering economic stability.

Recent meetings of the Federal Open Market Committee (FOMC) have revealed discussions on maintaining a delicate balance. While higher interest rates can help curb inflation, they also risk slowing economic growth and increasing unemployment. In November 2023, the FOMC indicated that while future rate hikes might still be on the agenda, they would proceed cautiously based on upcoming economic data, demonstrating their commitment to adapting to the economic environment.

The Broader Impact of the Fed’s Decisions

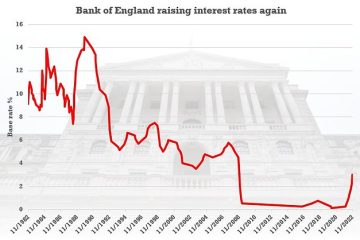

The Fed’s decisions have wide-ranging implications not just for the U.S. economy, but also for global markets. Changes in interest rates affect borrowing costs for consumers and businesses, influencing everything from mortgage rates to credit card interest, and even the stock market. Additionally, the Fed’s actions can influence foreign exchange rates, thereby affecting international trade.

Furthermore, the Fed’s communications and expectations about future policy directions play a significant role in shaping investor sentiment. For instance, any indication of a potential pivot towards cutting interest rates could lead to increased market optimism and investment in equities.

Conclusion

As the Federal Reserve navigates these complex economic conditions, its decisions will continue to remain under intense scrutiny. Analysts and economists will be watching for how the Fed manages inflation against the backdrop of potential economic growth slowdown. Understanding the Fed’s role and actions is vital for investors, policymakers, and consumers alike, as they will ultimately shape the economic landscape in the coming years. As we move into 2024, the Fed’s impact on the economy will be a crucial factor to watch, particularly in light of the increasing concerns around inflation and financial stability.