The Recent Trends in Netflix Share Price

Introduction

The Netflix share price has been a focal point for investors and analysts in recent years, reflecting both the company’s performance and broader market trends. As one of the leading streaming platforms globally, fluctuations in Netflix’s stock are often indicative of changes in consumer behaviour and the competitive landscape within the entertainment industry. Understanding the current dynamics surrounding Netflix’s share price can provide valuable insights for investors and stakeholders.

Recent Performance

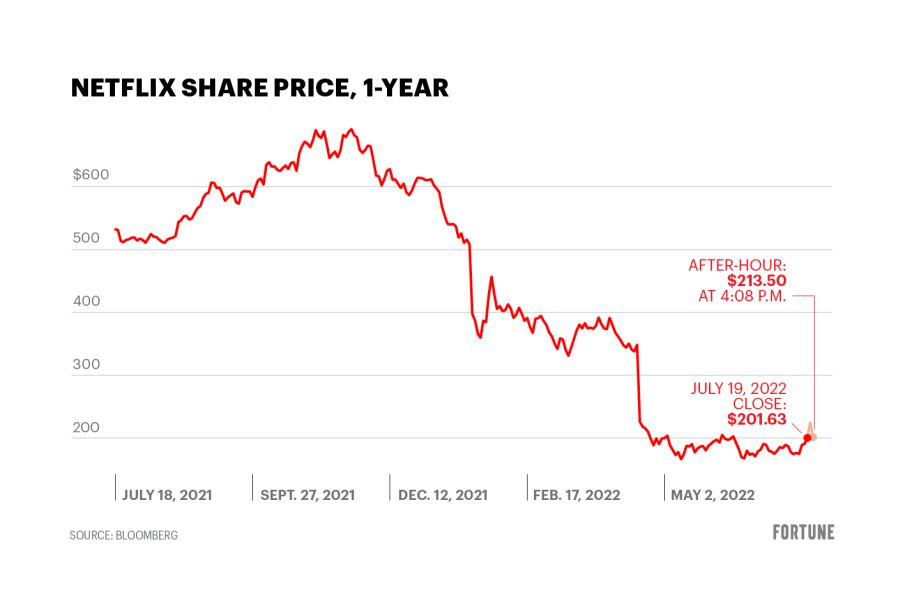

As of October 2023, Netflix has experienced a rollercoaster of price movements. After reaching an all-time high of approximately £485 per share in July 2021, the company saw significant declines throughout 2022, with prices dipping below £200. This downward trend was attributed to rising competition, inflationary pressures, and concerns over subscriber growth as streaming markets became saturated.

However, the tide appears to be turning for Netflix. Recently, the share price has shown a remarkable recovery, climbing to around £380 as of the latest reports. Analysts attribute this resurgence to a strategic focus on original content production, the introduction of a cheaper ad-supported subscription model, and robust international expansion efforts. As a result, Netflix has regained investor confidence and is poised to compete more effectively against rivals such as Disney+ and Amazon Prime Video.

Factors Influencing Share Price

Several key factors are currently influencing Netflix’s share price. Firstly, subscriber growth remains crucial. According to Netflix’s third-quarter earnings report, the company added 8.8 million new subscribers, exceeding analysts’ expectations. Such growth indicates that Netflix is successfully navigating the competitive landscape while responding to consumer preferences.

Additionally, operational costs and profit margins are closely monitored by investors. Netflix has been investing heavily in original content, and while this drives subscriber acquisition, it can also strain profit margins. Recent collaborations with prominent filmmakers and talent have helped to enhance content quality, which may ultiamtely translate to increased viewer retention and revenue stability.

Conclusion

In conclusion, the Netflix share price reflects a combination of internal performance metrics and external market conditions. With the company recovering from past lows and adapting to new challenges in the streaming industry, its shareholder value is being positively influenced by growth strategies and innovative pricing models. As the company continues to evolve and respond to the changing entertainment landscape, investors will be keenly watching the share price for signs of further growth or volatility. The coming months will be critical, especially with earnings reports and market responses expected to shape the future trajectory of Netflix’s stock. Ultimately, understanding these dynamics can help investors make informed decisions in a rapidly changing market.