The Nasdaq 100: A Comprehensive Overview

Introduction to the Nasdaq 100

The Nasdaq 100 index is a vital barometer of the performance of the largest non-financial companies listed on the Nasdaq Stock Market. This index includes major players in the technology, consumer services, and healthcare sectors, making it a significant representation of innovation and growth in the stock market. Investors and market analysts closely monitor the Nasdaq 100 as it reflects the health of the tech sector and provides insights into broader economic trends.

Current Trends and Recent Developments

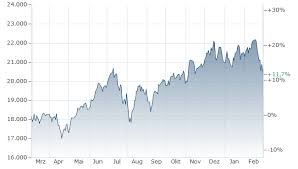

As of October 2023, the Nasdaq 100 has shown remarkable resilience amid various global economic challenges, including inflation and geopolitical tensions. The index has gained approximately 30% since the beginning of the year, largely driven by the performances of tech giants like Apple, Microsoft, and Alphabet. These companies have reported strong earnings, fuelling investor optimism and a surge in stock valuations.

In addition, the ongoing advancements in artificial intelligence (AI) and cloud computing continue to bolster the index’s growth. The rapid adoption of AI technologies is particularly notable, with several companies within the Nasdaq 100 leveraging these innovations to enhance their products and services, thus capturing consumer interest and corporate investment.

The Implications for Investors

For investors, the Nasdaq 100 serves as a gateway to some of the most influential technology and consumer-facing companies. Understanding the trends within this index is crucial for making informed investment decisions. Analysts suggest that while the growth trajectory appears promising, prospective investors should remain cautious. Factors such as interest rate changes, regulatory scrutiny of big tech, and global market volatility could influence future performance.

Moreover, the Nasdaq 100’s composition can lead to sector concentration risks. Investors should consider diversifying their portfolios to mitigate potential downturns in technology-driven markets.

Conclusion: Looking Ahead

The Nasdaq 100 represents both opportunities and challenges in today’s investment landscape. Its current momentum suggests that technology and innovation will continue to be driving forces in the economy. As we move into 2024, investors should keep a keen eye on economic indicators, corporate earnings, and market sentiment that could affect the index’s trajectory. By staying informed, investors can better navigate the complexities of the Nasdaq 100 and align their strategies for long-term success.