The Investment Philosophy of Warren Buffett

Introduction

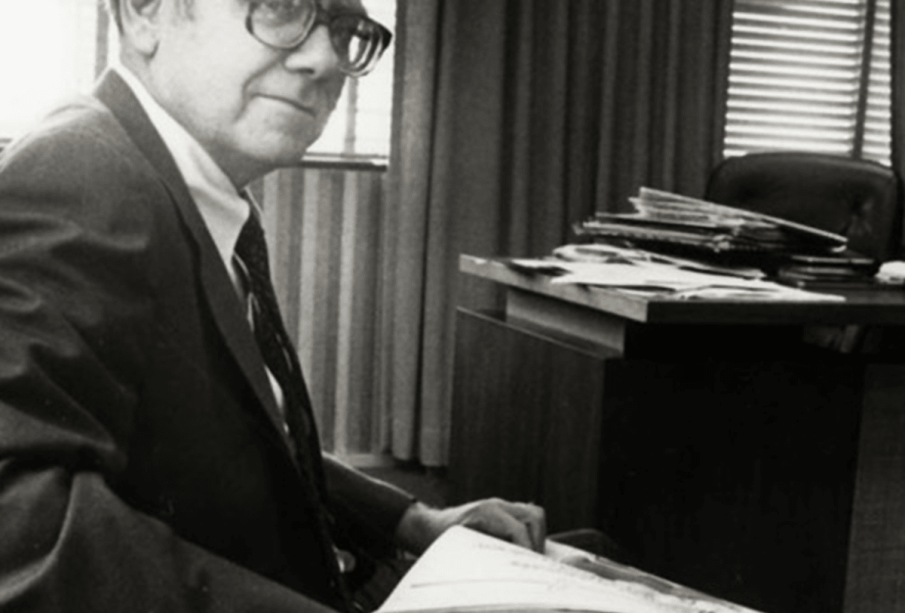

Warren Buffett, the chairman and CEO of Berkshire Hathaway, is widely recognised as one of the most successful investors of all time. Known as the ‘Oracle of Omaha’, Buffett’s investment strategies and insights have not only shaped the financial markets but have also influenced generations of investors around the globe. With a net worth exceeding $100 billion, his approach to value investing is as relevant today as it has ever been, particularly in the face of today’s volatile market conditions.

Buffett’s Investment Philosophy

Buffett’s investment philosophy centres around a principle known as value investing, which focuses on purchasing undervalued stocks with sound fundamentals. He believes in the importance of qualitative research and understanding the intrinsic value of businesses rather than merely reacting to market fluctuations. One of Buffett’s key strategies is to invest in companies that he understands well, ensuring a competitive edge in anticipating a company’s future performance.

Key Strategies and Lessons

1. Long-Term Perspective: Buffett advocates for a long-term approach to investing, suggesting that individuals should look to hold onto investments for many years, allowing compounding to work its magic.

2. Invest in What You Know: One of Buffett’s famous quotes, “Never invest in a business you cannot understand,” highlights the necessity of comprehending the dynamics of companies before investing.

3. Patience is Key: Buffett is known for using the phrase “the stock market is designed to transfer money from the Active to the Patient”. His ability to remain calm during market downturns exemplifies the virtue of patience in investing.

Recent Events

In recent months, Buffett has made headlines again for his strategic acquisitions and investments, including significant stakes in energy companies and technology firms. His decision to invest in Occidental Petroleum and Apple, among others, reflects his ongoing commitment to identifying value despite fluctuating economic indicators globally. Additionally, Berkshire Hathaway’s Annual Shareholders Meeting, often referred to as “Woodstock for Capitalists,” drew thousands of investors eager to learn more about Buffett’s latest insights and predictions for the economy.

Conclusion

Warren Buffett’s enduring legacy in the world of finance is not solely based on his wealth but also on his investment principles and philosophies that continue to resonate with both seasoned investors and novices. Looking ahead, as the economic landscape evolves, Buffett’s focus on value investing will likely remain a crucial aspect of successful investing strategies. His wisdom serves as a reminder that with the right approach, patience, and understanding, anyone can navigate the complexities of the financial markets effectively.