The Influence of Martin Lewis on UK Personal Finance

Introduction

In a time when financial literacy is increasingly important, Martin Lewis has emerged as a notable figure in the realm of personal finance in the UK. His ability to translate complex financial concepts into accessible information has made him a household name, particularly among consumers looking to navigate the intricacies of budgeting, saving, and investing. With ongoing issues surrounding rising living costs and economic uncertainty, the relevance of Lewis’s advice has never been clearer.

Who is Martin Lewis?

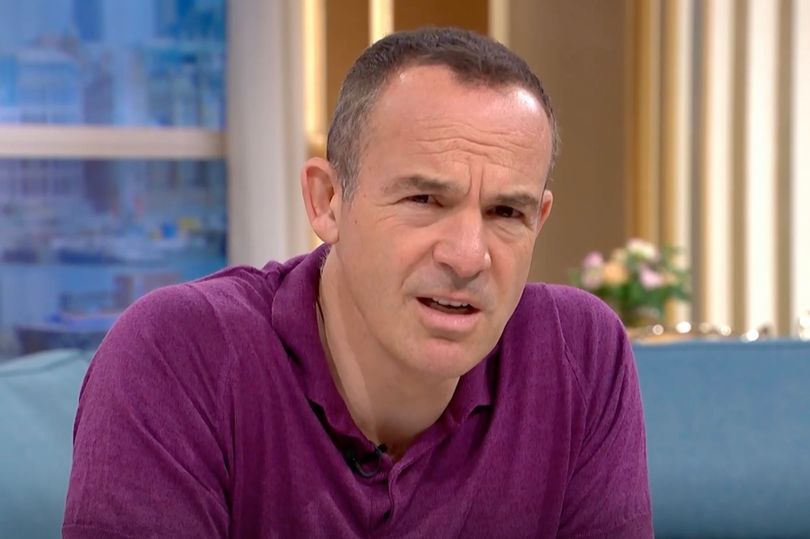

Martin Lewis, born on June 9, 1972, is a British journalist and television presenter best known for founding the consumer website MoneySavingExpert.com. Launched in 2003, the site quickly became one of the UK’s leading resources for financial advice, providing unbiased information on everything from insurance and loans to savings accounts. Lewis’s commitment to consumer rights is exemplified by his regular appearances on various television and radio platforms, where he offers practical financial tips.

Recent Events and Achievements

In recent months, Lewis has continued his mission to educate the public about financial issues, particularly relevant amidst the UK’s cost-of-living crisis. He has provided insights and actionable advice on energy bills, inflation effects, and how to maximise savings in a challenging economic landscape. Additionally, in early 2023, Lewis was awarded the Freedom of the City of London, recognising his contributions to consumer rights and education in finance.

Moreover, Lewis has launched several campaigns aimed at protecting consumers from exploitation by financial services. For instance, he has been vocal about the need for clearer pricing in the energy market and has successfully campaigned for improvements in customer service standards from major companies.

Conclusion

As Martin Lewis continues to advocate for consumer education and rights, his influence in the financial sector remains significant. His efforts not only empower individuals to make informed choices but also hold corporations accountable for fair practices. With ongoing economic challenges, the guidance provided by Lewis is likely to become increasingly relevant. For readers, keeping abreast of his advice could lead to improved financial well-being and a greater understanding of the personal finance landscape in the UK.