The Importance of Vehicle Tax in the UK and Recent Changes

Introduction to Vehicle Tax

Vehicle tax, commonly referred to as road tax or car tax, is a crucial aspect of vehicle ownership in the United Kingdom. It plays a significant role in funding transport infrastructure and ensuring that roads are maintained for public use. With growing discussions surrounding environmental concerns, the nature and structure of vehicle tax are becoming increasingly relevant, especially in light of recent changes to tax rates and policies.

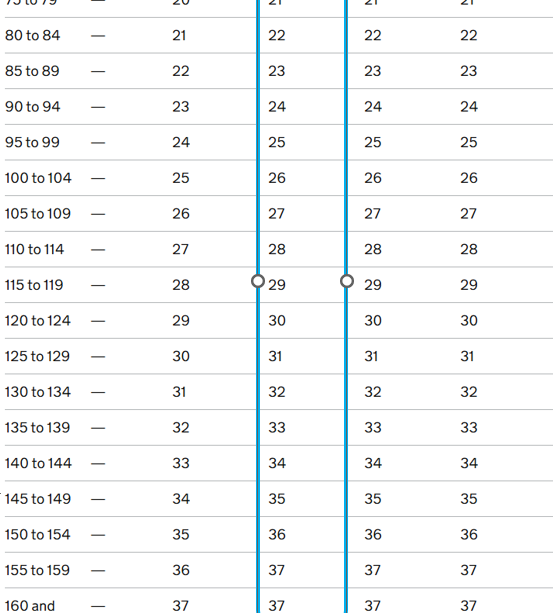

Current Rates and Regulations

The vehicle tax system in the UK depends on a number of factors including the vehicle’s CO2 emissions, type, and its age. As of April 2023, the vehicle tax rates have seen adjustments, particularly influencing drivers of newer models, which tend to incur higher charges due to their emissions output. For instance, zero-emission vehicles remain exempt from road tax, a move that aims to encourage the adoption of greener transport options.

Recent Developments

In the 2023 Budget, the UK government announced plans to revise the vehicle tax structure to better align with net-zero emissions targets. This includes increasing tax rates for higher-emission vehicles, while providing incentives and lower tax rates for electric and hybrid vehicles. The intention is to encourage more drivers to transition towards environmentally friendly options and to reduce the overall carbon footprint of the UK’s transportation sector.

Significance for Drivers

Understanding vehicle tax is vital for all drivers as it directly impacts the cost of ownership. With the anticipated changes in rates, motorists will need to evaluate their options and possibly consider switching to more environmentally friendly vehicles. Failure to compute vehicle tax properly can result in not only fines but also additional charges if vehicles are not correctly taxed for their emissions.

Conclusion and Future Outlook

In conclusion, vehicle tax represents more than just a fee; it is an important part of a broader strategy aimed at promoting sustainable transportation solutions. As rates evolve and regulations change, drivers must stay informed to navigate their responsibilities and make responsible choices regarding their vehicles. Looking ahead, the improvements in vehicle tax policies are likely to lead to increased adoption of electric vehicles, paving the way for cleaner air and improved public health. The balance between tax implications and environmental responsibility will shape the UK’s driving landscape for years to come.