The Importance of the Nikkei Index in Today’s Market

Introduction

The Nikkei Index, also known as the Nikkei 225, is one of the most significant stock market indices in Japan and a critical indicator of the country’s economic health. Tracking the performance of 225 large companies listed on the Tokyo Stock Exchange, it provides insights into the direction of the Japanese economy and serves as a barometer for investor sentiment worldwide.

Recent Trends in the Nikkei Index

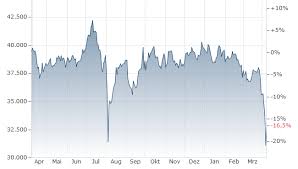

As of early October 2023, the Nikkei Index has shown remarkable resilience despite fluctuating global markets. Following an increase in manufacturing activity and a steady recovery from the impacts of the COVID-19 pandemic, the index has started climbing towards levels not seen since the late 1980s. On October 1st, the Nikkei closed at 33,528 points, reflecting an increase of 12% since the beginning of the year.

Analysts attribute this upward trend to various factors, including robust corporate earnings, particularly in the technology and automotive sectors, and a weaker yen which makes exports more competitive. Additionally, Japan’s central bank’s commitment to maintaining low-interest rates has also encouraged investment in equities, pushing the index higher.

Factors Influencing the Nikkei Index

Several factors contribute to the fluctuations in the Nikkei Index. Global economic conditions, such as changes in US interest rates, geopolitical tensions, and trade relations, play a crucial role. Moreover, domestic issues like consumer spending, employment rates, and government policies can significantly impact the performance of companies included in the index.

In recent developments, Japan has seen an increase in foreign investment, driven by historic low unemployment rates and an influx of venture capital into emerging markets. Also, with the government promoting policies aimed at stimulating growth and innovation, the positive sentiment has continued to bolster the outlook for the Nikkei Index.

Conclusion

In summary, the Nikkei Index remains an essential tool for understanding Japan’s economic landscape and the broader global market trends. Its recent performance has provided optimism for investors, even amidst potential obstacles like inflation and supply chain disruptions. Moving forward into 2024, analysts forecast continued growth, but caution remains as global uncertainties could still influence the index’s trajectory. For investors and market watchers alike, keeping an eye on the Nikkei Index will be vital in navigating the complexities of both the local and international economic environments.