The Importance of Pension Credit for Older Adults

Introduction

Pension credit is a crucial financial support mechanism in the United Kingdom designed to provide a safety net for older adults with low income. As many individuals reach retirement age, the importance of ensuring a stable and adequate income becomes paramount. Pension credit not only alleviates poverty among the elderly but also plays a significant role in enhancing their overall quality of life.

What is Pension Credit?

Pension credit consists of two parts: the guarantee credit and the savings credit. The guarantee credit ensures that individuals aged 66 and over have a minimum income level, while the savings credit rewards those who have modest savings or income above the basic state pension. For the 2023-2024 financial year, the maximum weekly guarantee credit amount is £201.05 for single people and £306.85 for couples.

Recent Changes and Impact

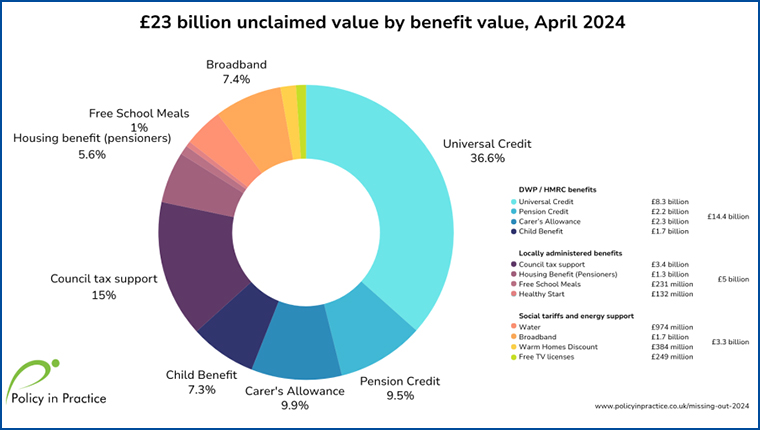

As of April 2023, the UK government announced an increase in pension credit rates, reflecting the ongoing efforts to support vulnerable seniors amidst rising living costs. This adjustment aims to counteract inflationary pressures, which have disproportionately affected older adults depending on fixed incomes. According to the Department for Work and Pensions, approximately 1.4 million households currently receive pension credit, yet an estimated 850,000 eligible households remain unclaimed. This discrepancy highlights the need for increased awareness of pension credit benefits.

How to Apply

Eligibility for pension credit is determined by various factors, including income, savings, and living arrangements. Older individuals can apply for pension credit through the official government website or by contacting the pension credit helpline. It is advisable for applicants to have all relevant financial documentation ready to expedite the process.

Conclusion

In conclusion, pension credit is a vital resource that can significantly improve the financial stability of older adults in the UK. Given the current economic climate and the rising cost of living, it is imperative for eligible individuals to recognise and claim this support. The government’s efforts to raise awareness and accessibility of pension credit could potentially lift hundreds of thousands of seniors out of poverty, ensuring they live their retirement years with dignity and financial security. Observing ongoing trends in claims and financial support will be essential as the country navigates its way through economic recovery.